Boston luxury first-time homebuyers. Are you aware of this?

Downtown Boston real estate for sale

If you’re a first-time homebuyer, you might feel like the odds are stacked against you in today’s market. But there are resources and programs out there that can help – if you know where to look. And one thing that can make homeownership easier to achieve? An FHA home loan.

They’re designed to help you overcome some of the biggest financial hurdles in the homebuying process – and that’s why so many first-timers are using them to make their purchase.

Whether you’re dreaming of ditching rent, planting roots, or just wanting a place that’s truly yours, an FHA home loan could be the path that gets you there sooner than you think.

Buying Your First Home Probably Doesn’t Feel Easy Right Now

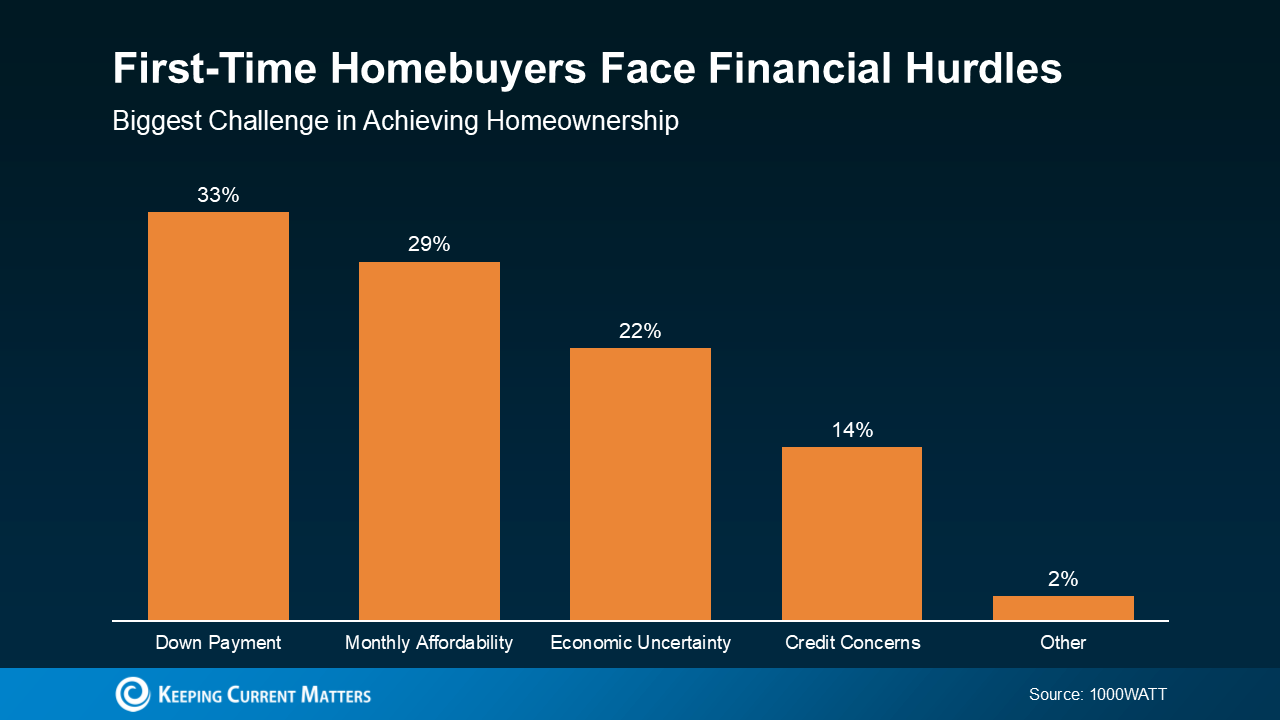

While the motivation to buy a home is still there for many people, affordability is a real challenge today. According to a survey from 1000WATT, potential first-time buyers say their top two concerns are saving enough for their down payment and making the monthly mortgage payments work at today’s home prices and mortgage rates (see graph below):

That’s Where FHA Loans Come In

That’s Where FHA Loans Come In

FHA loans help many first-time buyers overcome these challenges.

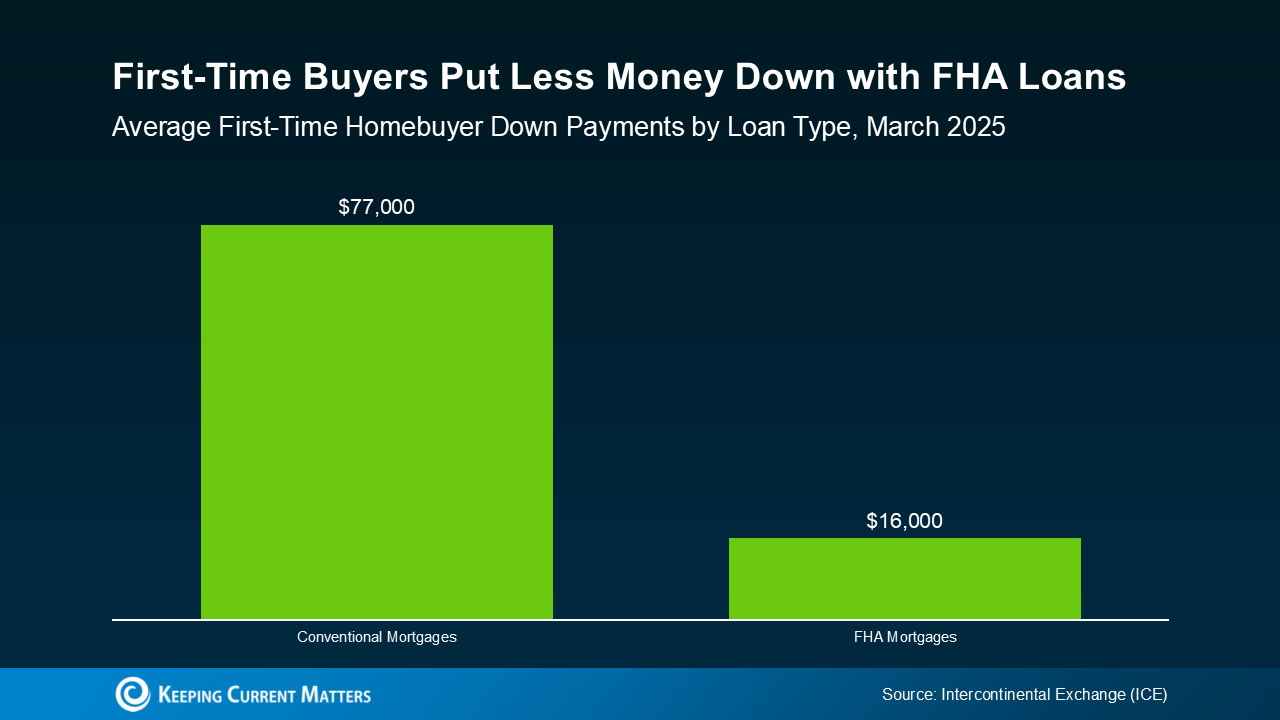

In fact, according to Intercontinental Exchange (ICE), the average first-time buyer using an FHA loan puts down just $16,000. That’s a big difference from the $77,000 they’re putting down with the typical conventional mortgage (see graph below):

Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

That’s because, a lot of the time, the mortgage rate on FHA loans can be lower. Bankrate says:

“FHA loan rates are competitive with, and often slightly lower than, rates for conventional loans.”

So, if you’re thinking about buying your first place, an FHA loan may be worth exploring.

Because of the potential for lower down payment requirements and maybe even a lower mortgage rate, it could help with the two most common hurdles first-time buyers face today – saving enough money upfront and affording the monthly payment.

A trusted lender can walk you through the details, compare your options, and help you figure out what loan type makes the most sense for your situation.

Condos for Sale in Boston and the Bottom Line

With the right loan and the right guidance, homeownership may be more achievable than you think.

Do you want to talk more about your options? A trusted lender is there to help.

Boston luxury first-time homebuyers. Are you aware of this?

- President Biden has proposed a “mortgage relief credit” of $5,000 per year for two years for middle-class, first-time homebuyers.

- He is also calling for a one-year credit of up to $10,000 for middle-class families who sell their “starter homes” to another owner-occupant.

- However, experts have mixed opinions about whether the policies will help the country’s housing affordability issues.

“I know the cost of housing is so important to you,” Biden said during his State of the Union speech Thursday night.

Understanding what most mortgage lenders are looking for can require a bit of homework. However, it’s important to note that the eligibility criteria will not always be the same. In most cases, it will vary based on the loan type and lender. Here are a few factors that remain common among those requirements when purchasing a Boston condo for sale in today’s market.

Consistent Income is necessary to buy a Boston condo for sale

Most lenders will immediately ask you to provide proof of employment and consistent income in the form of pay stubs, tax returns, etc. This is because they want to ensure you can afford to repay the loan. They may also consider your financial emergency assets, money market accounts, etc. Please have all this lined up when applying for a Boston condo for sale.

Credit Score is important to purchase a Boston Condo for Sale

The credit score is one of the most important factors your mortgage lender considers. A good score showcases your ability to repay loans on time and portrays reliability.

However, there is no universal credit score requirement because it usually depends on the type of mortgage you’re seeking. A conventional loan may require you to have at least 620.

It’s also possible to qualify with a lower score for other types of mortgages, such as the ones backed by the US Department of Agriculture and the Federal Housing Administration. The rule of thumb is to ensure that your credit score is high because the higher it is, the better your chances of qualifying for a good interest rate.

Down Payment For Boston Condo Financing

The down payment you’re required to make also depends on the type of mortgage and lender. Conventional mortgages usually require 3% of the property’s purchase price.

However, most people prefer putting at least 20% into the down payment to avoid PMI (Private Mortgage Insurance). The good news is that a USDA (US Department of Agriculture) loan doesn’t require a down payment.

Most lenders assess the risk involved by looking at the money you put down. This means the more down payment there is, the lesser the risk for them. This isn’t it. A large down payment also reduces your LTV or loan-to-value ratio, which is another appealing factor to lenders.

DTI or Debt-to-Income Ratio tp purchase a Boston Condo for Sale

The DTI ratio is basically the amount in monthly debt payments you owe compared to the income you earn. Typically, it shouldn’t be higher than 50% if you wish to qualify for a mortgage. Lenders also take your housing expenses into account when determining whether you’re a good fit for the loan. These expenses may include your property taxes, homeowner’s insurance, and your mortgage.

___________________________________________________________________________________________________

Boston luxury first-time homebuyers. Are you aware of this?

Consumers have been closely following President Joe Biden’s proposed first-time homebuyer tax credit, but the latest legislative effort to assist homebuyers differs in several significant ways. The newest draft of a down-payment assistance bill would provide $25,000 to first-time homebuyers, but only those who are also first-generation homebuyers and economically disadvantaged. Plus Biden’s proposal is not actually a homebuyer tax credit, but it is money that would be available at closing.

On Wednesday, lawmakers published a draft version of the legislation, the “Downpayment Toward Equity Act of 2021,” ahead of a hearing held by the U.S. House Committee on Financial Services, which Rep. Maxine Waters chairs. During the hearing, lawmakers discussed a number of housing measures on the table in President Biden’s infrastructure package, including funding to shore up public housing.

The proposed down payment assistance would be means-tested based on income, and limited to those who have not owned a house for at least three years. To qualify, neither of the borrower’s parents may have owned a home. That qualification doesn’t apply if the borrowers’ parents lost their home in a foreclosure or short sale, or if the borrower has ever been in foster care, however.

Borrowers who make no more than 120% of the area median income where they live — or if they live in a high-cost area, 180% — would qualify for a baseline of $20,000. Those recognized as socially disadvantaged, because they are in a group that has been “subjected to racial or ethnic prejudice,” could receive an additional $5,000.

The grant funding — which is not a tax credit — could be used at closing toward a downpayment on a residential property with one to four units, including a condominium, cooperative project or manufactured housing unit.

The program, which is currently being discussed in the House of Representatives, would dole out funds to states based on population, median area home prices and racial disparities in homeownership rates.

Downtown Boston real estate for sale

_________________________________________________________________________________________________________________________________________________________________________

If any first-time home buyers were on the fence about taking a more traditional starter home path to homeownership in 2020, the Covid-19 pandemic brought into focus the way they viewed homes and what they really wanted for a dream home.

For Millennial home buyers, this past year’s change in the economy, employment and especially dropping interest rates offered surprises, with 47% being pleasantly surprised that they could afford a higher-priced home, according to a generational insights report by realtor.com. On the flip side, 21% were surprised that their budget was lower than they thought.

Downtown Boston real estate for sale

Source: Boston luxury Condos for Sale

That’s Where FHA Loans Come In

That’s Where FHA Loans Come In