Boston high rise condos for sale: No housing crash in 2025

Boston Downtown High-Rise Condos for Sale in 2025

This content is currently unavailable. Please check back later or contact the site's support team for more information.

Boston high rise condos for sale: No housing crash in 2025

There’s been a lot of recession talk over the past couple of years. And that may leave you worried we’re headed for a repeat of what we saw back in 2008. Here’s a look at the latest expert projections to show you why that isn’t going to happen.

According to Jacob Channel, Senior Economist at LendingTree, the economy’s pretty strong:

“At least right now, the fundamentals of the economy, despite some hiccups, are doing pretty good. While things are far from perfect, the economy is probably doing better than people want to give it credit for.”

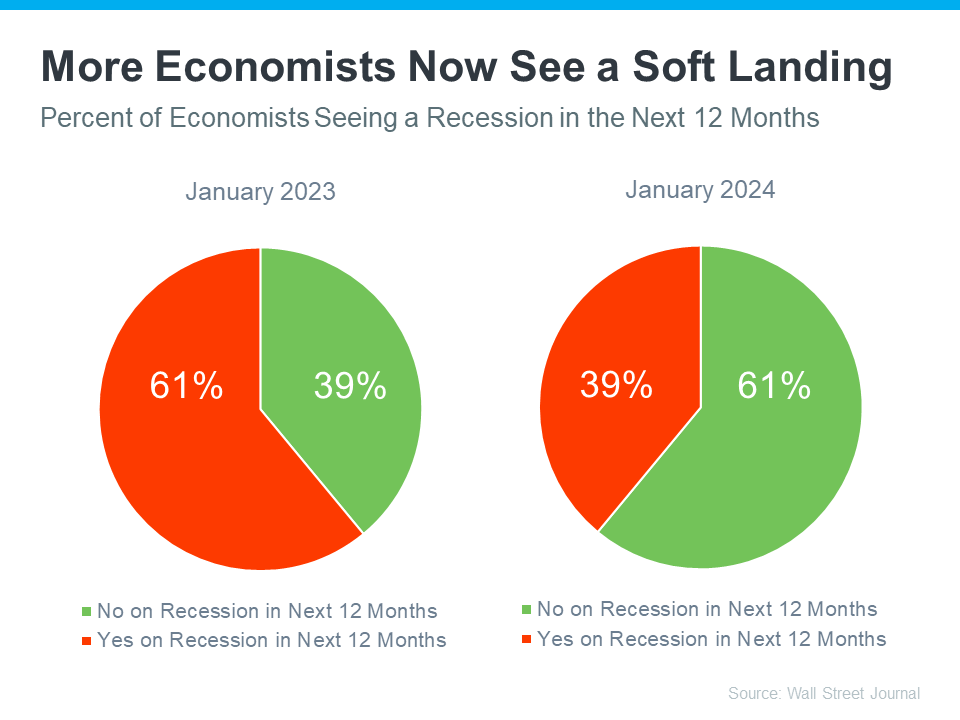

That might be why a recent survey from the Wall Street Journal shows only 39% of economists think there’ll be a recession in the next year. That’s way down from 61% projecting a recession just one year ago (see graph below):

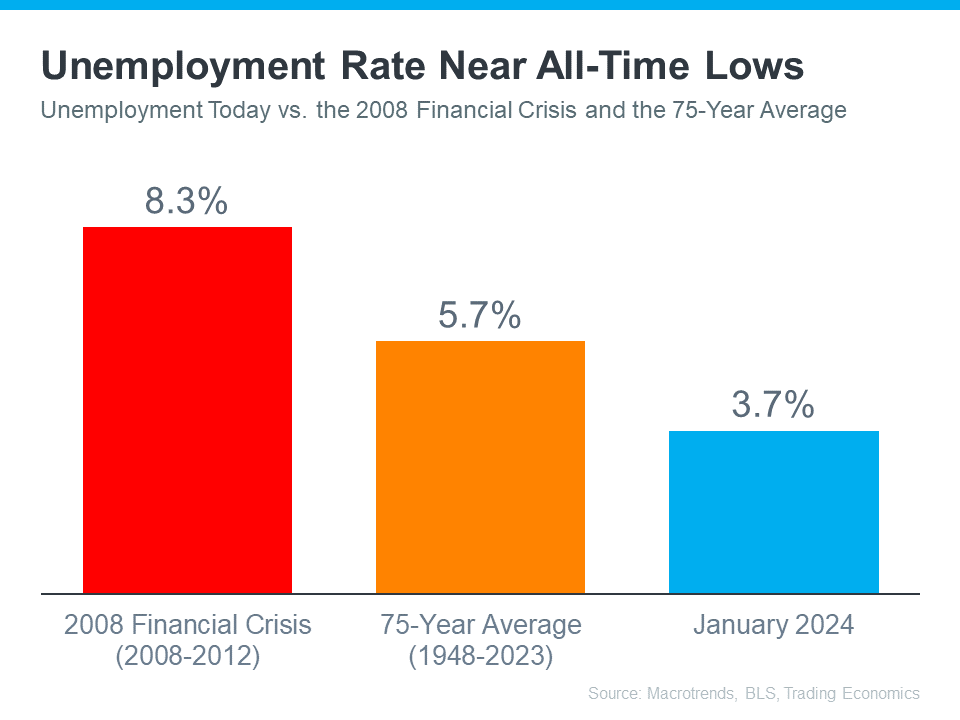

Most experts believe there won’t be a recession in the next 12 months. One reason why is the current unemployment rate. Let’s compare where we are now with historical data from Macrotrends, the Bureau of Labor Statistics (BLS), and Trading Economics. When we do, it’s clear the unemployment rate today is still very low (see graph below):

The orange bar shows the average unemployment rate since 1948 is about 5.7%. The red bar shows that right after the financial crisis in 2008, when the housing market crashed, the unemployment rate was up to 8.3%. Both of those numbers are much larger than the unemployment rate this January (shown in blue).

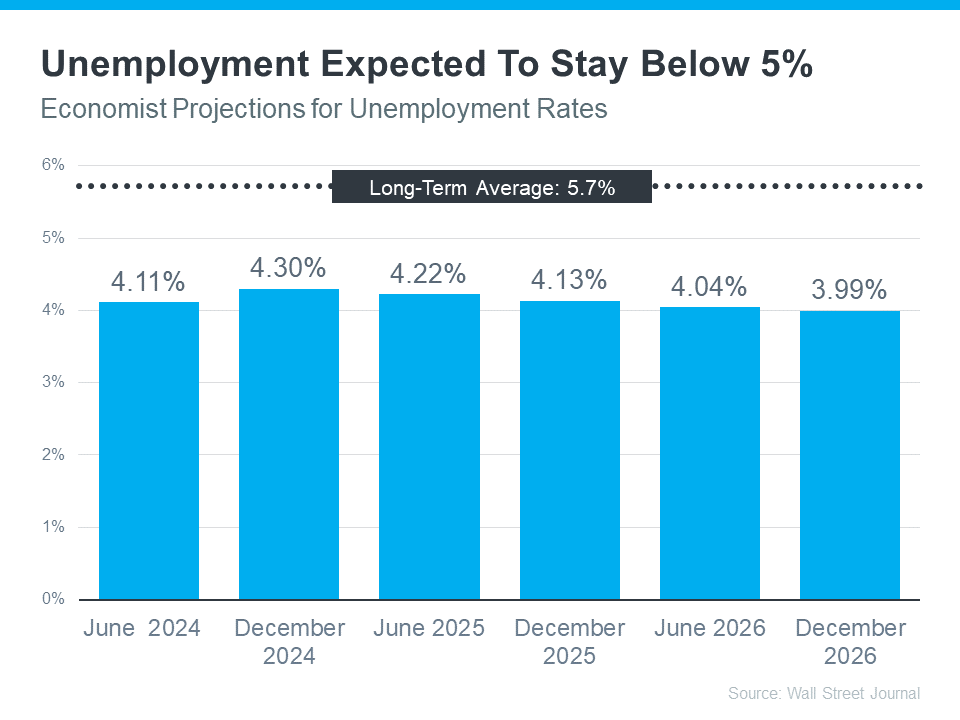

But will the unemployment rate go up? To answer that, look at the graph below. It uses data from that same Wall Street Journal survey to show what the experts are projecting for unemployment over the next three years compared to the long-term average (see graph below):

As you can see, economists don’t expect the unemployment rate to even come close to the long-term average over the next three years – much less the 8.3% we saw when the market last crashed.

Still, if these projections are correct, there will be people who lose their jobs next year. Anytime someone’s out of work, that’s a tough situation, not just for the individual, but also for their friends and loved ones. But the big question is: will enough people lose their jobs to create a flood of foreclosures that could crash the housing market?

Looking ahead, projections show the unemployment rate will likely stay below the 75-year average. That means you shouldn’t expect a wave of foreclosures

Boston Condos and the Bottom Line

Most experts now think we won’t have a recession in the next year. They also don’t expect a big jump in the unemployment rate. That means you don’t need to fear a flood of foreclosures that would cause the housing market to crash.

____________

Boston high rise condos for sale: No housing crash in 2025

There’s been some concern lately that the housing market is headed for a crash. And given some of the affordability challenges in the housing market, along with a lot of recession talk in the media, it’s easy enough to understand why that worry has come up.

But the data clearly shows today’s market is very different than it was before the housing crash in 2008. Rest assured, this isn’t a repeat of what happened back then. Here’s why.

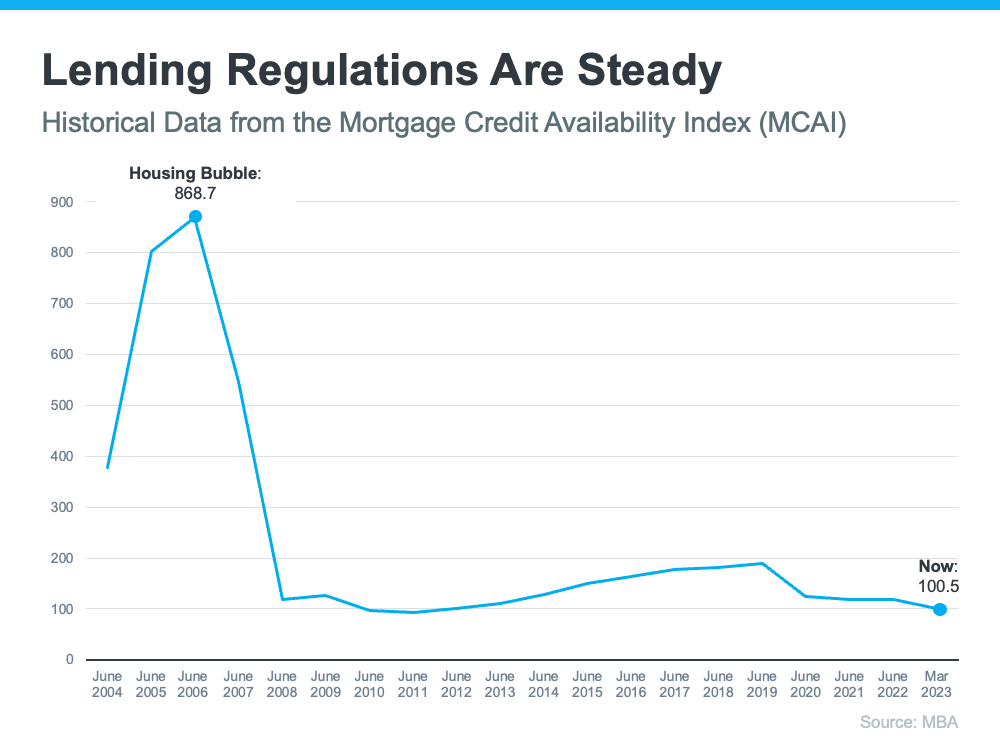

It’s Harder To Get a Loan Now

It was much easier to get a home loan during the lead-up to the 2008 housing crisis than it is today. Back then, banks had different lending standards, making it easy for just about anyone to qualify for a home loan or refinance an existing one. As a result, lending institutions took on much greater risk in both the person and the mortgage products offered. That led to mass defaults, foreclosures, and falling prices.

Things are different today as purchasers face increasingly higher standards from mortgage companies. The graph below uses data from the Mortgage Bankers Association (MBA) to show this difference. The lower the number, the harder it is to get a mortgage. The higher the number, the easier it is.

Unemployment Recovered Faster This Time

Unemployment Recovered Faster This Time

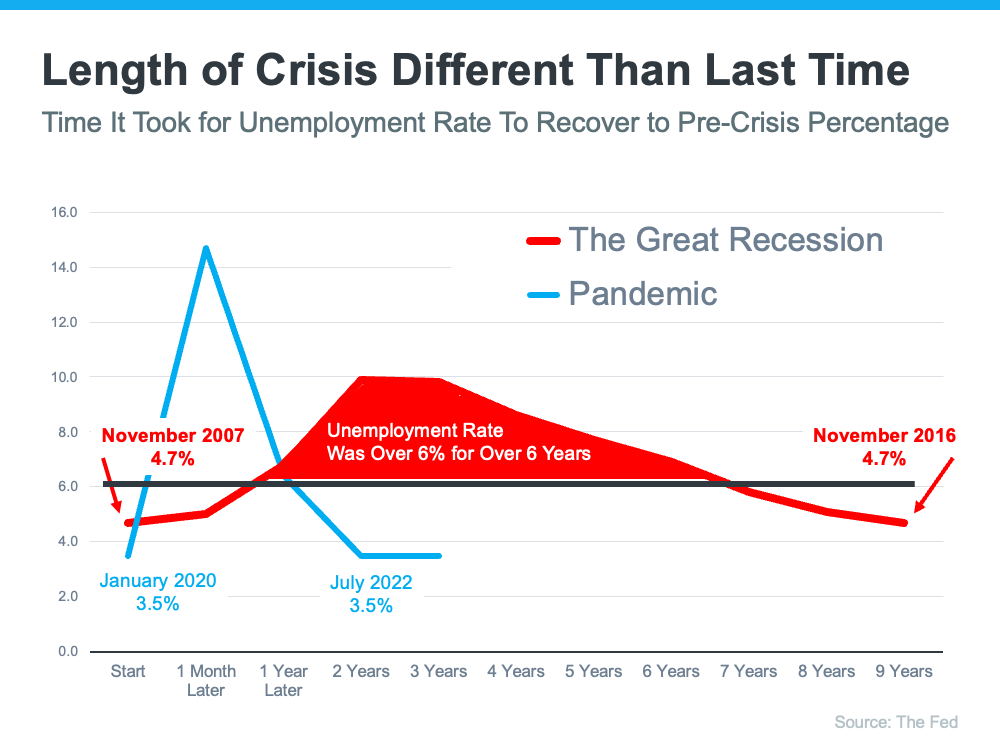

While the pandemic caused unemployment to spike over the last couple of years, the jobless rate has already recovered back to pre-pandemic levels (see the blue line in the graph below). Things were different during the Great Recession as a large number of people stayed unemployed for a much longer period of time (see the red in the graph below):

Here’s how the quick job recovery this time helps the housing market. Because so many people are employed today, there’s less risk of homeowners facing hardship and defaulting on their loans. This helps put today’s housing market on stronger footing and reduces the risk of more foreclosures coming onto the market.

There Are Far Fewer Homes for Sale Today

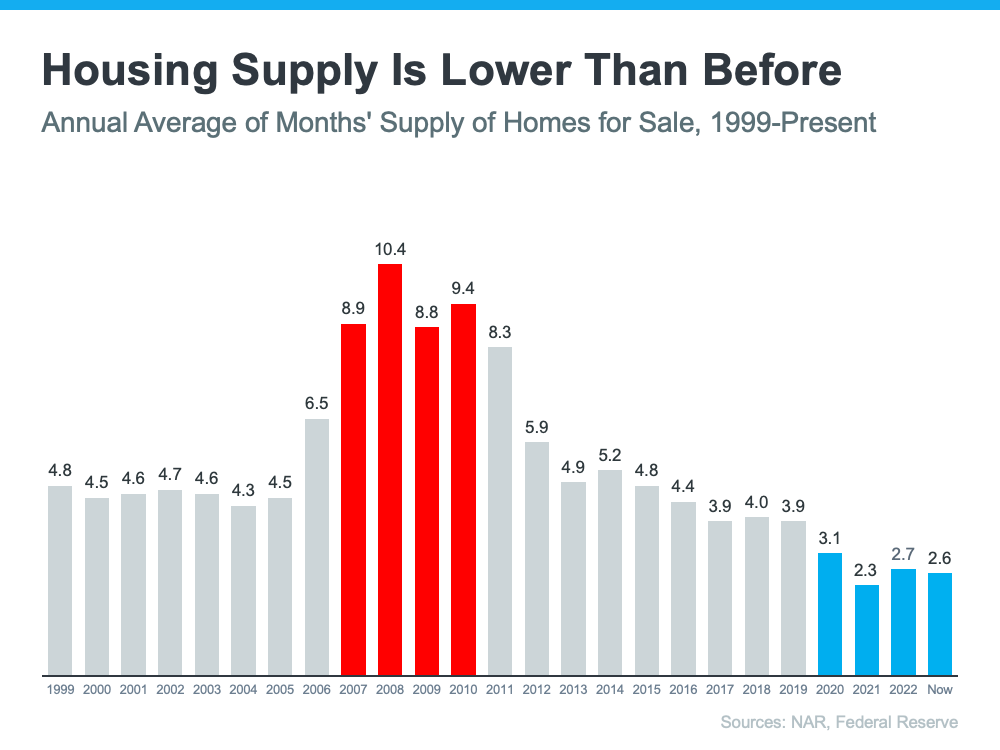

There were also too many homes for sale during the housing crisis (many of which were short sales and foreclosures), and that caused prices to fall dramatically. Today, there’s a shortage of inventory available overall, primarily due to years of underbuilding homes.

The graph below uses data from the National Association of Realtors (NAR) and the Federal Reserve to show how the months’ supply of homes available now compares to the crash. Today, unsold inventory sits at just a 2.6-months’ supply. There just isn’t enough inventory on the market for home prices to come crashing down like they did in 2008.

Equity Levels Are Near Record Highs

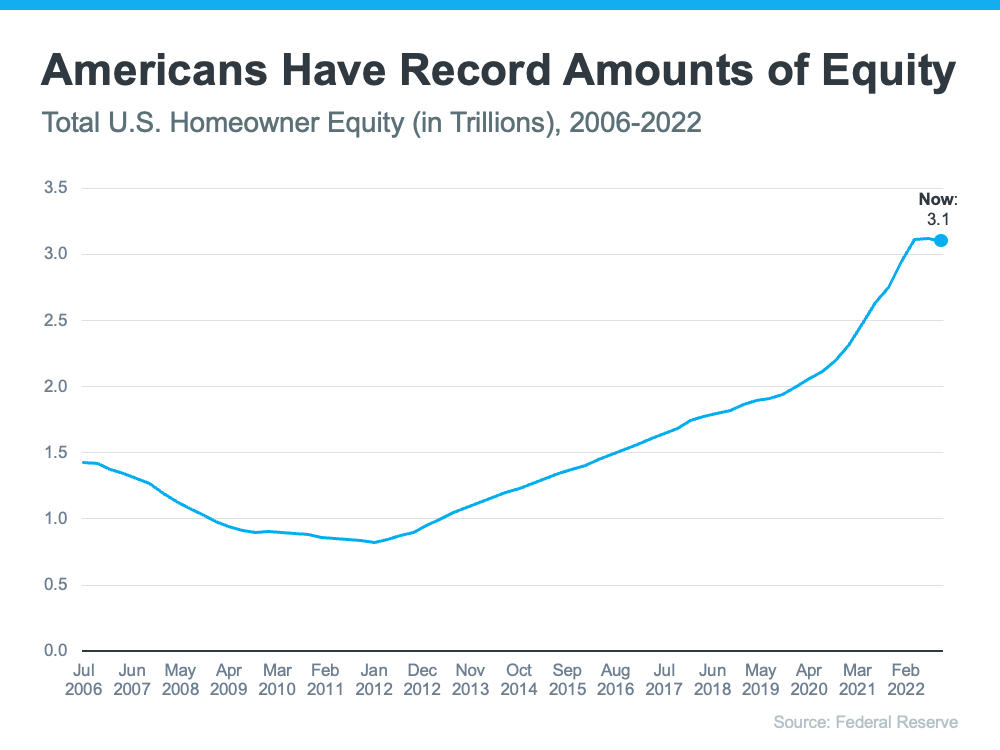

That low inventory of homes for sale helped keep upward pressure on home prices over the course of the pandemic. As a result, homeowners today have near-record amounts of equity (see graph below):

And, that equity puts them in a much stronger position compared to the Great Recession. Molly Boesel, Principal Economist at CoreLogic, explains:

“Most homeowners are well positioned to weather a shallow recession. More than a decade of home price increases has given homeowners record amounts of equity, which protects them from foreclosure should they fall behind on their mortgage payments.”

Boston High Rise Condos and the Bottom Line

The graphs above should ease any fears you may have that today’s housing market is headed for a crash. The most current data clearly shows that today’s market is nothing like it was last time.

_______________________________________________________________________________________________________________________________________

Boston high rise condos for sale: No housing crash in 2025

There is a lot of uncertainty regarding the Boston high-rise condo market heading into 2019. That uncertainty has raised concerns that we may be headed toward another housing crash like the one we experienced a decade ago.

Here are four reasons why today’s market is much different:

1. There are fewer foreclosures now than there were in 2006

A major challenge in 2006 was the number of foreclosures. There will always be foreclosures, but they spiked by over 100% prior to the crash. Foreclosures sold at a discount and, in many cases, lowered the values of adjacent homes. We are ending 2018 with foreclosures at historic pre-crashnumbers – much fewer foreclosures than we ended 2006 with.

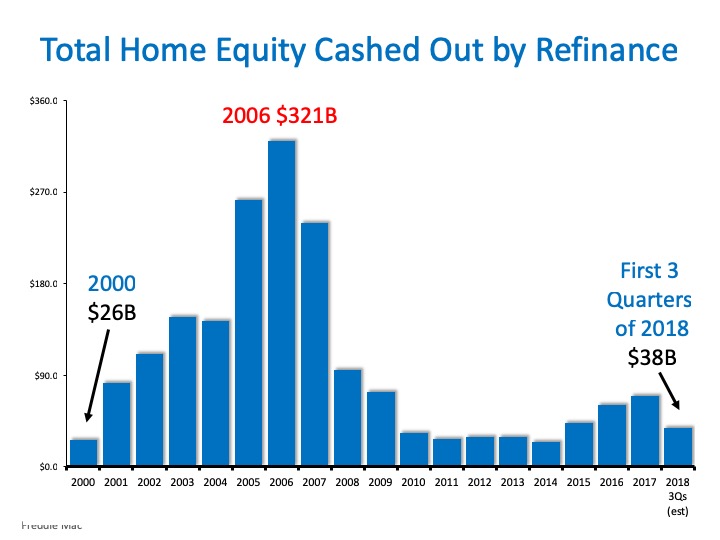

2. Most homeowners have tremendous equity in their homes

Ten years ago, many homeowners irrationally converted much, if not all, of their equity into cash with a cash-out refinance. When foreclosures rose and prices fell, they found themselves in a negative equity situation where their homes were worth less than their mortgage amounts. Many just walked away from their houses which led to even more foreclosures entering the market. Today is different. Over forty-eight percent of homeowners have at least 50% equity in their homesand they are not extracting their equity at the same rates they did in 2006.

3. Lending standards are much tougher

One of the causes of the crash ten years ago was that lending standards were almost non-existent. NINJA loans (no income, no job, and no assets) no longer exist. ARMs (adjustable rate mortgages) still exist but only as a fraction of the number from a decade ago. Though mortgage standards have loosened somewhat during the last few years, we are nowhere near the standards that helped create the housing crisis ten years ago.

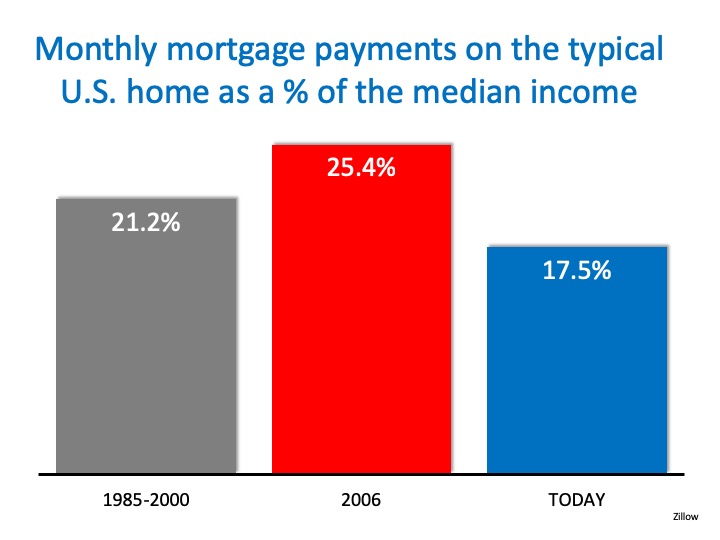

4. Affordability is better now than in 2006

Though it is difficult to afford a home for many Americans, data shows that it is more affordable to purchase a home now than it was from 1985 to 2000. And, it requires much less of a percentage of your income today than it did in 2006.

Boston high rise condos for sale: No housing crash in 2024

Boston Downtown High-Rise Condos for Sale in 2021

This content is currently unavailable. Please check back later or contact the site's support team for more information.

Which Boston neighborhoods have high-rise condo buildings?

Boston high-rise condo buildings are mostly in two Boston neighborhoods Midtown and the Seaport District.

What is the average sales price for a downtown Boston high-rise condo?

The average sales price for a Boston high-rise condo in 2021 is $1,792,648.00

What is the avg number of Boston high-rise condos for sale in 2021?

The avg number of Boston high-rise condos for sale is approx 100 – 150

What is the average size of a Boston high-rise condo?

The average size of a Boston high-rise condo is 1,141.27 sq ft. in 2021.

What is the average sales price per sq ft for a Boston high-rise condo in 2021?

The average price for a Boston high-rise condo in 2021 is $1,4474.00 per sq ft.

Boston Downtown Condos and Real Estate for Sale

Bottom Line

The housing industry is facing some rough waters heading into 2019. However, the graphs above show that the market is much healthier than it was prior to the crash ten years ago.