Boston real estate for sale

Changes in real estate tax law for 2021 (Everything you need to know)

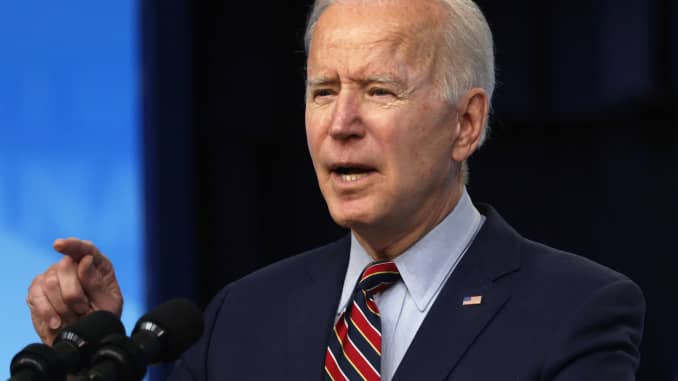

- President Joe Biden will propose a capital gains tax increase for households making more than $1 million per year. The top rate would jump to 39.6% from 20%.

- These changes may hit homeowners looking to sell in hot markets.

- Those affected can reduce their tax bill with advanced planning, financial experts say.

Boston real estate taxes

As home prices soar, some sellers in red-hot markets may face a costly surprise come tax time.

President Joe Biden will propose in a nationwide address Wednesday a capital gains tax increase for the top 0.3% of households — those making more than $1 million per year.

But the proposal may also deliver a tax bill to those selling a home with significant gains.

Wealthy Americans now paying the top capital gains rate could see a hike to 43.4%, from 23.8%. Both rates include a 3.8% levy on net investment income, created by the Affordable Care Act.

The tax increases may impact more than stocks, bonds and cryptocurrency, however. Homeowners looking to cash in on sizzling home prices could also receive a bill.

“The proposed increase in federal as well as state capital gains tax rates could sting [home sellers] on the margins,” said Sharif Muhammad, founder and CEO of Unlimited Financial Services in Somerset, New Jersey.

Real estate tax exclusion

Even with median home prices reaching all-time highs, Muhammad said, many sellers avoid paying capital gains on home profits because of a special tax break.

There’s a strict IRS rule, though: It must be the seller’s primary home for two out of five years before closing on the sale, with a few exceptions, like a job- or health-related move

Boston Condos for Sale

___________________________________________________________________________________________________________________________________________________________________________