How to Get a Greater Credit Score?

How to Get a Greater Credit Score?

Boston Condos for Sale and Rent

Loading...

10 Credit Score Mistakes to Avoid – Improve Your Credit Score Now!

Every year, millions of people struggle to secure a home, get approved for a loan, or even land their dream job – all because of one looming number: their credit score. Whether it’s your first venture into adulting or your golden years, maintaining a good credit score is crucial in today’s world. It all starts with avoiding the common credit mistakes that can take that coveted 800+ credit score and send it spiraling down into the depths of financial despair. Hold on tight as we list down the top 10 biggest blunders you make with your credit score and how to steer clear from them! Are you ready to fix your credit? Let’s dive in!

What Is a Good Credit Score? – Ford Realty Inc

Avoiding late payments, not monitoring your credit report for errors, and co-signing on loans that you cannot afford to pay are some of the most significant mistakes that can negatively impact your credit score. Maxing out your credit cards, applying for numerous new lines of credit, closing old accounts, and ignoring bills or debts can also hurt your credit standing. Other common culprits include carrying high balances on your credit cards and committing bankruptcy or foreclosure. To maintain good credit health, ensure you stay current with all bills and monitor your debt-to-credit ratio.

Understanding Credit Score Importance

Your credit score is a measure of how well you handle finances, making it a crucial aspect of your financial health. It affects all aspects of your financial life, including mortgage rates, insurance premiums, and credit card approvals. By understanding the importance of having a good credit score, you will be better equipped to manage your finances in a responsible manner.

No matter which stage of life you are in, having good credit opens up a world of possibilities. Are you looking to purchase or lease a car? You’ll need a good credit score to show lenders that you’re reliable enough to make payments on time. Trying to secure a mortgage for your dream home? That’s right, you need a good credit score for that too. Even something as simple as renting an apartment or getting a credit card requires good credit.

Not only can good credit help you achieve and maintain financial stability, but it can also help save money in the long run. A higher credit score can lead to lower interest rates on loans and credit cards, reducing the amount of money paid over time towards interest fees. Furthermore, some employers may check an applicant’s credit score during the hiring process, particularly those applying for jobs in finance or accounting.

Think of your credit score like your GPA in school – it measures your academic progress and tells universities what kind of student you are. Similarly, your credit score measures your financial progress and informs lenders what kind of borrower you are.

With such significant implications associated with our credit scores, it is essential we learn more about how they can affect us financially.

Credit Score Ranges – Ford Realty Inc

Disconnect Between Credit Score and Financial Health

As important as our credit scores are, there’s often a disconnect between our scores and our actual financial health. Some believe that their scores represent how much money they have saved or their overall income, when in reality it focuses more on whether you’re financially reliable. This misconception can lead to reckless borrowing habits or an incorrect view of one’s financial wellbeing.

It is important that we recognize that our credit scores offer a snapshot of our behavior as borrowers and not our entire financial situation. Just because someone has a low credit score doesn’t mean they are poor or managing money poorly; just the same, having a high score does not automatically indicate considerable wealth or stability.

Let’s say you have two people with $50,000 in credit card debt. Person A keeps making minimum payments each month but never misses a payment and might even work toward paying down that balance each month. In contrast, Person B misses monthly payments and falls into collections after being unable to make any payments over time. Person A may still wind up with lower credit than person B simply because they have not paid off their debt yet entirely.

Thus, while our credit scores tell us how well we are handling our finances concerning borrowing money and making payments back on the borrowed funds, it doesn’t necessarily reflect the entirety of one’s financial picture.

Consider your credit score as a snapshot of your current fitness level – it tells you how well you’re doing at this moment, but not your general health.

Understanding the disconnect between your credit score and financial health is crucial. By knowing the purpose of your score it will empower you to live better financially overall.

- Close to 35% of your credit score is determined by your payment history, making late payments the biggest mistake impacting credit scores according to MyFICO.

- The Consumer Financial Protection Bureau estimates that as many as 20% of U.S. adults have at least one error on their credit reports.

- A study by CreditCards.com found that over half (55%) of U.S. adults have utilised more than 30% of their available credit limit – a significant contributing factor in lowering credit scores.

Impacts of Late Payments and Unpaid Debt

Your payment history makes up 35% of your credit score. Just one late payment can cause a significant drop in your credit score of up to 100 points, according to Experian. That’s why it’s essential to always make payments on time and in full.

Say you had a medical bill that you thought insurance would cover, but it didn’t. You figure you’ll pay the bill when you have some extra money next month. Unfortunately, that month comes and goes, and you forget about the bill until the collection agency starts calling. Before too long, this one-time mistake has impacted your credit score negatively.

There are numerous potential repercussions for neglecting bills or loans. Late payments and missed payments affect your credit utilization ratio—the amount of debt owed compared to the total credit available—and play a crucial role in determining your FICO credit score.

Some might argue that a missed payment is only a small dent in the bigger financial picture. However, consider this: Every 30 days that a bill remains overdue is another black mark on your credit report. If enough delinquencies occur, significant actions such as wage garnishment could be taken just because of poor credit standing.

Think of your credit standing like a musical instrument. It takes precise tuning for everything to harmonize correctly. Suppose you’re not making consistent payments on time each month, like not tuning one string correctly or missing notes altogether. In that case, it is hard to achieve or maintain financial harmony.

The next section also covers how late payments affect overdue bills and loans.

Overdue Bills, Loans, and Their Effects on Credit Scores

Overdue bills or loans can also have harsh effects on your credit score, causing it to plummet if not taken care of properly.

Suppose you had an outstanding medical bill or a late car payment sitting on your desk for months without any action taken to pay them in full. In that case, that debt may be sent to collections, further ruining your credit score. Similar to the previous section, consistent late payments across different accounts accumulate and signal to lenders that you are not dependable when it comes to money matters.

Creditors’ reports on such delinquencies would drastically lower your FICO credit score and cause future loans to come with excessive interest rates or even be denied credit altogether.

Some might argue that there could be legitimate reasons for delayed payment occasionally, such as extenuating emergencies or overzealous billing practices. Still, regardless of the reason behind such delays, the effects will still negatively impact their credit standings.

Consider that overdue bills are like weeds in your garden. The longer they remain unattended, the more issues they can cause down the line until it becomes a much larger problem than originally anticipated.

It’s crucial to always keep up with your bills regularly and keep track of due dates to ensure your credit score remains healthy.

The Harm of Carrying High Debt

A major factor that influences your credit score is the amount of debt you carry. When considering your creditworthiness, lenders consider your credit utilization ratio, which reflects how much of your available credit you are using. If you’re carrying a high amount of debt, it can negatively affect your credit score. It not only makes lenders think that you may not be managing your finances well but also increases the risk of default and missed payments.

Let’s take an example to make this point clearer. Suppose you have a credit card with a limit of $10,000, and you owe $9,000 on that card. This means your credit utilization ratio is at 90%—a very high percentage that gives lenders pause when considering whether to extend more credit to you or not.

Carrying high debt loads can lead to financial stress and even bankruptcy in the long run. When you have a lot of outstanding debt, it can be hard to keep up with payments and may force you to take out new loans or credit cards just to stay afloat.

High levels of debt can also affect your mental health as it leads to anxiety, depression, and sleepless nights worrying about money. This stress can exacerbate other problems in your life, such as work-related pressure or family obligations.

While having debt isn’t inherently bad, carrying too much for too long can hinder your financial future. Many people believe that taking on more debt than they can afford is necessary to build their businesses or live the life they want. This mindset has led several individuals into unmanageable financial situations.

However, there are alternatives to relieve yourself from the burden of high debt levels such as getting professional help from financial planners or consolidating outstanding loans to one single amount with lower interest rates.

Think of carrying high debt levels like carrying a backpack filled with bricks. The more weight you carry, the more physical, mental and emotional stress it exerts on you, leading to discomfort and possible long-term issues like stamina and vitality.

Now that we understand how harmful high debt levels can be to our credit scores let’s examine other factors determining our creditworthiness in more detail.

Debt Load and Its Impact on Credit Scores

Debt load represents the overall amount of debt you owe relative to your income. While having some level of debt is necessary for most individuals—mortgages, student loans, car payments—it’s good to keep this level within a reasonable limit.

If your debt load is too high or continues to rise without proper handling or control, it can have adverse effects on your credit score. This also makes it difficult for you to obtain new credit requests or make loans as you represent a risk of default when lending institutions evaluate your credit application.

For example, suppose you have three credit cards with limits of $10,000 each and owe $3,000 on each card. Your total outstanding balance is $9,000 out of a potential $30,000 limit. While 30% is an acceptable credit utilization ratio according to the experts, it could lead to an adverse effect if you already have existing loans or mortgages under your name.

To avoid any negative consequences of high debt loads on your credit score, regularly evaluate your expenses against your earnings. It’s essential to look at items that exceed what’s needed and try to bring these expenditures within reason.

In addition, creating a budget and working towards paying down your debts will go a long way towards improving your financial state-of-mind and reducing the stress from maintaining overdue bills.

Many people believe that having high debt indicates borrowing by choice unless unforeseeable circumstances dictated financial hardship. Accordingly, it presents a false assumption that the borrower lacks responsibility to manage finances and commit to timely payments.

However, unforeseeable circumstances like an unexpected job loss or medical emergency happen. Which is why it’s critical to have an emergency fund in place so you can handle unforeseen events that affect your financial stability and ability to pay down debts.

Think of debt load as being on a tightrope. If you have too much outstanding debts, it may lead to poor creditworthiness, whereas having too little or none may cause hesitant lending institutions that could refuse to lend you money due to no established credit history.

Understanding how debt loads influence your credit score is an important piece of maintaining good credit health. We must continue looking at other expenses, bills, and loans affecting our credit standing while always working towards financial responsibility.

Repercussions of Incorrect Credit Report Information

Your credit score is one of the most important aspects of your financial life. It can impact everything from the interest rates you receive on loans to your ability to rent a home or get a job. But what happens when incorrect information is reported to the credit bureaus, leading to an inaccurate credit report?

Imagine that you recently made a payment on your credit card, but it’s not reflected on your credit report. This could lead to your credit utilization ratio being higher than it actually is, resulting in a lower credit score. Or, perhaps there’s a collection account listed on your report that doesn’t belong to you. This could harm your score and may even be a sign of identity theft.

According to research conducted by the Federal Trade Commission, one in five consumers have errors in their credit reports. These errors can range from simple inaccuracies, such as an incorrect address or employment history, to more serious mistakes like unreported debt payments and incorrect account balances. Regardless of the type of error, any mistake on your credit report can have harmful repercussions for your financial future.

Some people may believe that checking their credit report isn’t necessary since they don’t believe they’ve made any mistakes. However, it’s always better to be safe than sorry when it comes to your finances. Regularly checking your credit report can help you catch any mistakes before they spiral out of control and impact your score. Additionally, staying on top of your credit report can give you an idea of how much progress you’re making towards achieving good credit.

So, what happens if you do find an error on your credit report? The first step is to dispute the error with both the creditor and the credit bureau reporting it. You may need to provide documentation proving that the information is incorrect. Once the dispute is filed, the credit bureau has 30 days to investigate your claim and remove any inaccurate information.

Think of your credit report like a resume for your financial history. Just like a mistake on a resume can be a deal breaker for a job opportunity, errors on your credit report can make it more difficult to get approved for loans or credit cards. Keeping an accurate credit report is just as important as keeping an accurate resume – both impact your financial future.

In conclusion, incorrect information on your credit report can have harmful repercussions for your financial future. It’s essential to regularly review your credit report and dispute any inaccuracies that you find. By staying on top of your credit report, you can help ensure that your credit score remains healthy and accurate.

- Regularly checking your credit report is crucial to catching any mistakes before they spiral out of control and harm your financial future. Disputing errors with both the creditor and the credit bureau reporting it is necessary, and staying on top of your credit report can help ensure that your credit score remains healthy and accurate. Just like a mistake on a resume can be a deal breaker for a job opportunity, errors on your credit report can make it more challenging to get approved for loans or credit cards. Keep an accurate credit report, like keeping an accurate resume, is critical since both impact your financial future.

Updated: Boston Real Estate Blog 2023

_______________________________________________________________________________________________

Mortgage interest rates are near historic lows. Yet if you want to take advantage of those rates, check your credit score first.

That three-digit number determines whether you can get a mortgage, the type of loan you’ll get, what you’ll pay in interest, and potentially how much money you need for a down payment. In this hot downtown Boston real estate market, that could make difference in your success, experts say.

The importance of credit score and buying a Boston condo

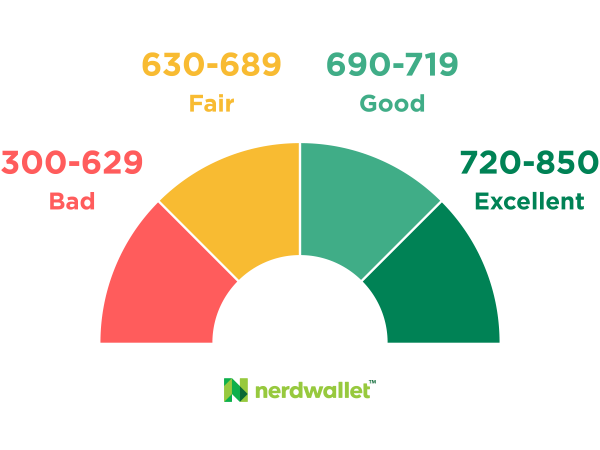

Credit scores range from 300 to 850. A good score is 670 to 739, very good is 740 to 799, and 800 and up is considered excellent, according to FICO, a leading credit-scoring company.

Homebuyers who took out mortgages in the fourth quarter of 2020 had a median score of 786, according to the Federal Reserve Bank of New York.

Boston condo buyers check your credit history

You are allowed one free credit report a year from the three main credit-scoring companies: Experian, Equifax and TransUnion. You can reach out to each directly or you can access them through annualcreditreport.com.

Not only should you know your score, but you should also make sure there are no mistakes or unintended skeletons in your closet, like a missed payment you forgot about.

Pulling your report before you apply for a mortgage or preapproval, ideally a few months in advance, will give you time to correct any issue

If you’re looking to refinance or buy a Beacon Hill Condo, or even rent an apartment, potential lenders and owners will be checking your credit scores. And if those scores are being verified, chances are they are going down.

Yes, you read that correctly. Each time a credit score is pulled from one of the three credit bureaus as part of a loan application, it can decline by as much as 20 points or more.

How to build up your credit

Pay bills on time

Late or missed payments can knock down your score.

The easiest way to avoid that is to set up automated payments for your bills, Daugs said.

Get a credit-builder loan

Some community banks and credit unions offer credit-building loans, which are designed to help the holder build credit as they make payments.

You’ll pay interest, although some lenders may reimburse the costs after the loan is repaid.