Buying a Boston condo for sale or renting, which is better for you?

Boston Condos for Sale and Apartments for Rent

Buying a Boston condo for sale or renting, which is better for you?

You may have seen reports in the news recently saying it’s more affordable to rent an apartment right now than it is to buy a Boston condo for sale. And while that may be true in some markets if you just look at typical monthly payments, there’s one thing that the numbers aren’t factoring in: and that’s home equity. Here’s a look at how big of an impact equity can have and why it’s worth considering as you make your decision.

What the Headlines Are Based on

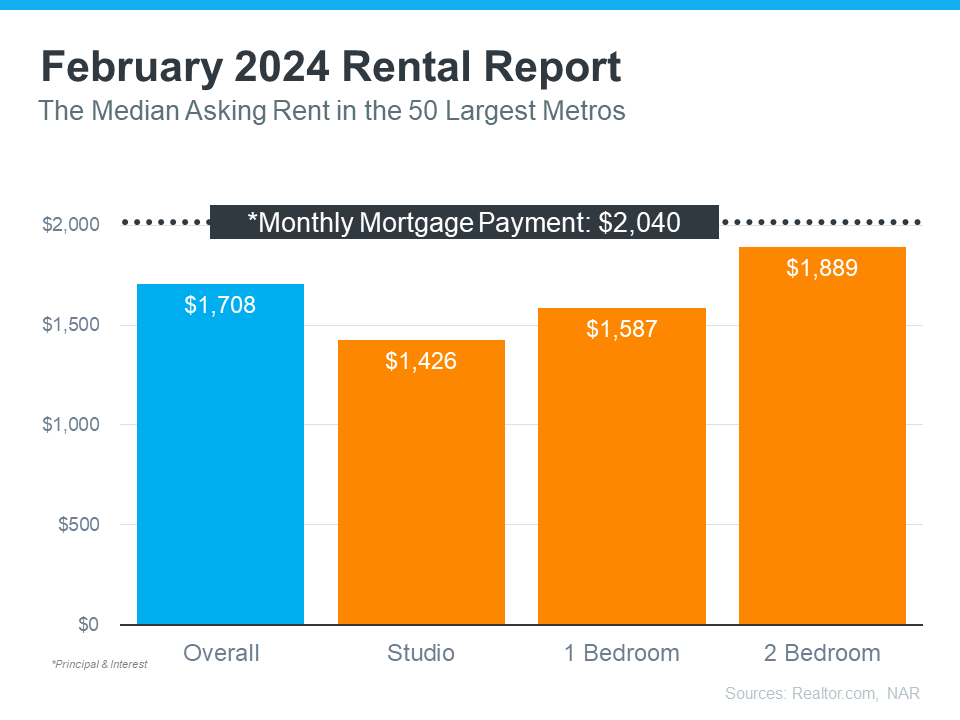

The graph below uses national data on the median rental payment from Realtor.com and median mortgage payment from the National Association of Realtors (NAR) to compare the two options. As the graph shows, especially if you’re not looking for a lot of space, it can be more affordable on a monthly basis to rent:

But if you’re looking for something with 2 bedrooms, the gap between the median rent and the median mortgage payment starts to shrink to a difference that may be more doable. The median monthly mortgage payment is $2,040. The median monthly rent for 2 bedrooms is $1,889. That’s a difference of about $151 a month. But here’s what happens when you factor in equity too.

How Equity Changes the Game

If you rent, your monthly rental payments only go toward covering your housing costs and your landlord’s expenses. So other than saving a bit more per month and maybe getting your rental deposit back when you move, the money you spent on housing each month is gone – forever.

When you buy, your monthly mortgage payment pays for your shelter, but it also acts as an investment. That investment grows in the form of equity as you make your mortgage payment each month and chip away at what you owe on your home loan. Your equity gets an extra boost as home values climb – which they typically do.

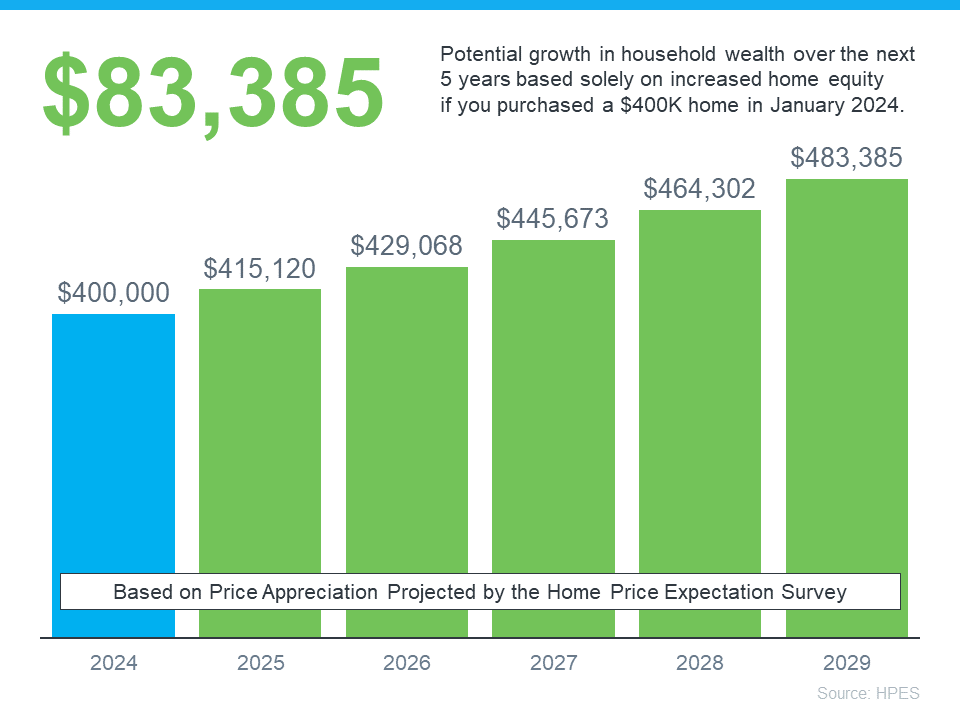

To give you a clearer idea of how equity can really stack up fast, here’s some data for you. Each quarter, Fannie Mae and Pulsenomics publish the results of the Home Price Expectations Survey (HPES). It asks more than 100 economists, real estate professionals, and investment and market strategists what they think will happen with home prices. In the latest release, those experts say home prices are going to keep going up over the next five years.

Here’s an example of how equity builds based on the projections from the HPES (see graph below):

Imagine you purchased a home for $400,000 at the start of this year. Chances are, since you bought, you plan to stay put for a while. Based on the HPES projections, if you live there for 5 years, you could end up gaining over $83,000 in household wealth as your home grows in value.

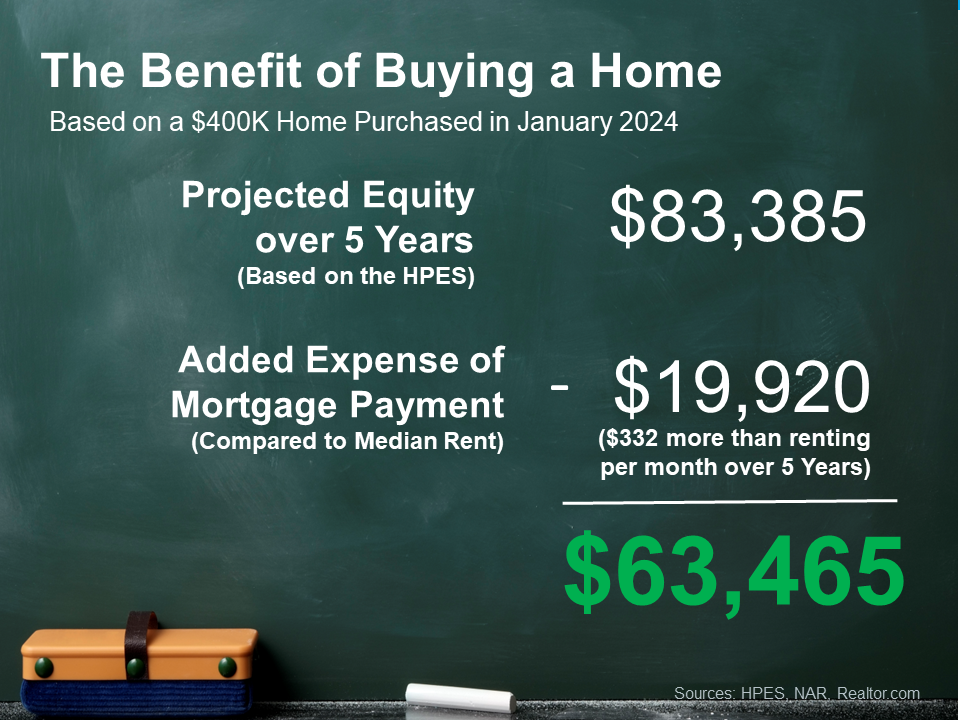

Here’s how that stacks up compared to renting, using the overall median rent from above:

While you may save a bit on your monthly payments if you rent right now, you’ll also miss out on gaining equity.

So, what’s the big takeaway? Whether it makes more sense to rent or buy is going to vary based on your personal finances. It’s not a good idea to buy if the numbers truly don’t work for you. But, if you’re ready and able, adding equity as the final puzzle piece may be enough to help you realize buying a Boston condo is a better move in the long run.

Boston Condos and the Bottom Line

When it comes down to it, buying a home gives you a benefit renting just can’t provide – and that’s the chance to gain equity. If you want to take advantage of long-term home price appreciation, let’s go over your options.

_________________

Buying a Boston condo for sale or renting, which is better for you?

Buying a Boston condo for sale or renting, which is better for you?

![The Difference Between Renting and Owning [INFOGRAPHIC] | Simplifying The Market](https://files.simplifyingthemarket.com/wp-content/uploads/2022/02/24125800/20220225-MEM.png)

In the Boston downtown real estate market where Boston condos for sale prices are rising, many have begun to reexamine the idea of buying a home, choosing instead, to rent for a while. But often, there is a dilemma: should you keep paying rent, knowing that rent is rising too, or should you lock in your Beacon Hill cost and buy a home?

Let’s look at both scenarios and analyze the pros and cons of each:

Renting

With the housing market crash in 2008, many homeowners lost their downtown Boston condos and became renters. According to Iproperty Management, “the number of households renting their home … rose from 31.2% of households in 2006 to 36.6% in 2016”.

Some choose to rent because it is more convenient for their lifestyle. Those whose job requires frequent moves need the flexibility that a 6-12 month lease agreement gives them so they can move to their next assignment!

Many renters believe that renting is cheaper because they do not have to pay for maintenance and repairs. (Not true! Landlords work those expenses into your rent and other fees). Another reason many rent a downtown Boston luxury condo is that they feel like they cannot afford the down payment and closing costs required to buy a house, due to their inability to save much after paying their monthly expenses.

That can be true! Nearly 1 in 4 renters spend at least half their household income on rent. In 2017 the “severely” burdened renters’ rate was 24.7% with 24.9% reporting they were “moderately” burdened.

Renting also brings some financial disadvantages. Boston Charles River Park condo owners can take advantage of tax deductions that let them claim their property taxes and mortgage interest. Additionally, there is a big risk that your rent will go up every time you renew your lease, as we know the median asking rent has been increased steadily since 1988!One of the major challenges with renting is that you don’t have a space to call your own. When you rent, you are paying your landlord’s mortgage, and therefore they are the beneficiaries of the equity gained from paying that mortgage.

Now let’s explore the other side: Homeownership

In the past, we have mentioned the many financial and non-financial benefits of becoming a homeowner. So, let’s just focus on the one big difference between renting and owning, the ability to lock in your housing cost!

Assuming you will have a fixed-rate mortgage, your costs are predictable! You will know exactly what your mortgage payment will be for the next 15-30 years. The homeownership rate in 2018 was 64.4%, and has been on the rise. Those households locked in their housing cost rather than wait for their landlord to raise their rent again!

What are the disadvantages of owning a Beacon Hill home? Well, it is a long-term financial commitment! It is not easy to pack quickly and move. You will need time and good planning to do it in a short amount of time.

You need to save your money! Getting a mortgage requires a down payment, closing costs, and moving expenses. Again, that will require some savings and planning!

Unless you have a condo association (HOA) (and you pay an HOA fee) or a home warranty, you will be responsible for maintenance and taking care of the home. This may range anywhere from regular landscaping to major repairs.

Bottom Line

Like everything in life, there are pros and cons. What is better for you depends on your situation! If you are interested in becoming owner of a Beacon Hill condo or Boston Seaport luxury condo and want to discuss the pros and cons, let’s get together to help you review your current situation and answer any questions you may have!