How much do I need for a downpayment on a Boston condo?

Boston Condo for Sale Search

How much do I need for a downpayment on a Boston condo?

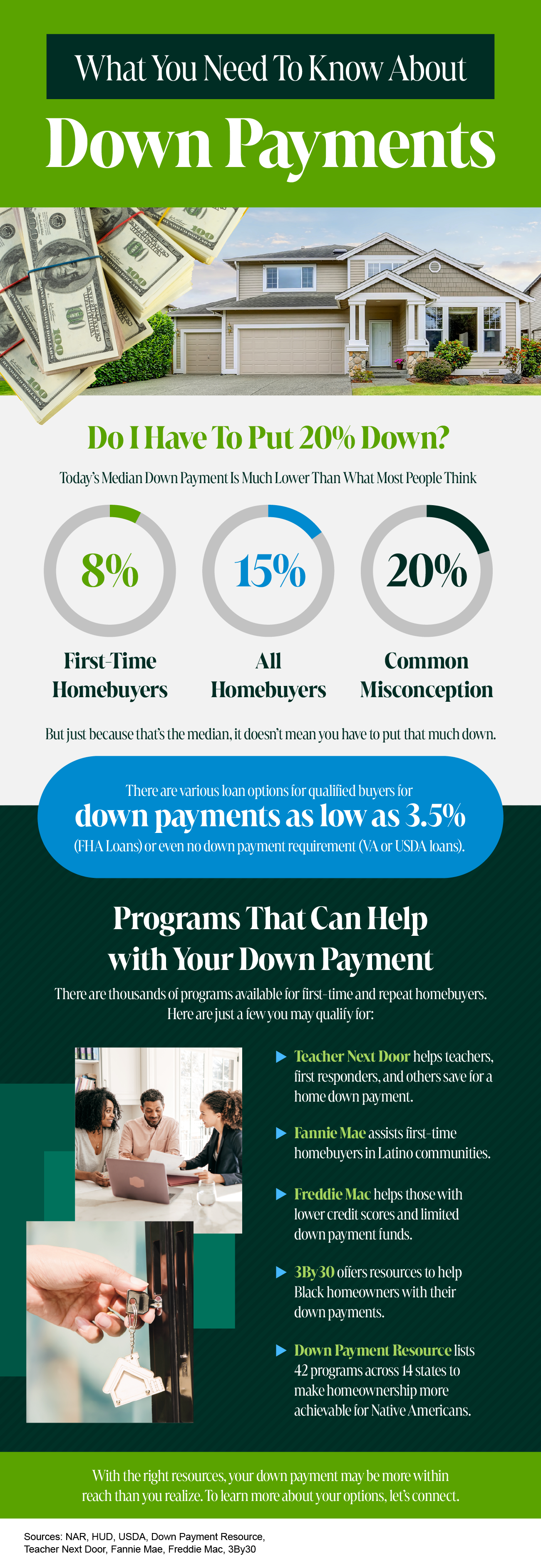

Saving up to buy a Boston condo for sale can feel a little intimidating, especially right now. And for many first-time condo buyers, the idea that you have to put 20% down can feel like a major roadblock.

But that’s actually a common misconception. Here’s the truth.

Do You Really Have To Put 20% Down When You Buy a Boston Condominium?

Unless your specific loan type or lender requires it, odds are you won’t have to put 20% down. There are loan options out there designed to help first-time buyers like you get in the door with a much smaller down payment.

For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants, like Veterans. So, while putting down more money does have its benefits, it’s not essential. As The Mortgage Reports says:

“. . . many homebuyers are able to secure a home with as little as 3% or even no down payment at all . . . the 20 percent down rule is really a myth.”

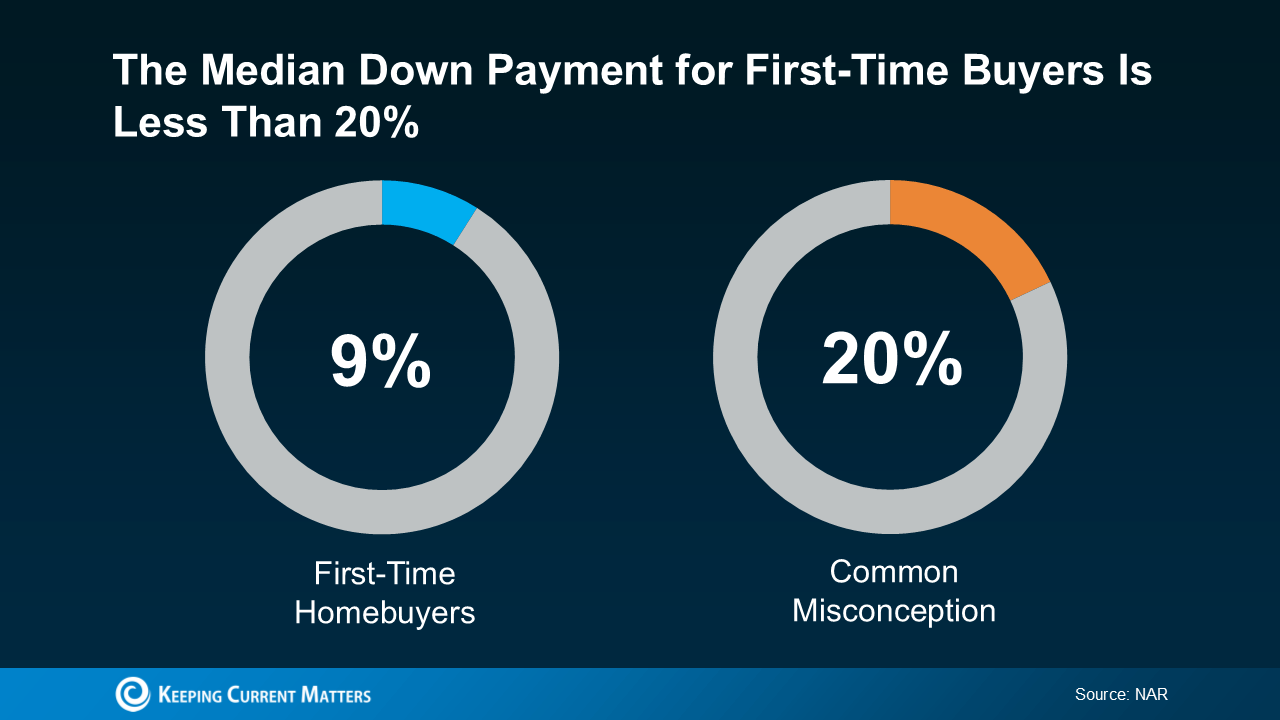

According to the National Association of Realtors (NAR), the median down payment is a lot lower for first-time homebuyers at just 9% (see chart below):

The takeaway? You may not need to save as much as you originally thought.

The takeaway? You may not need to save as much as you originally thought.

And the best part is, there are also a lot of programs out there designed to give your down payment savings a boost. And chances are, you’re not even aware they’re an option.

Why You Should Look into Down Payment Assistance Programs

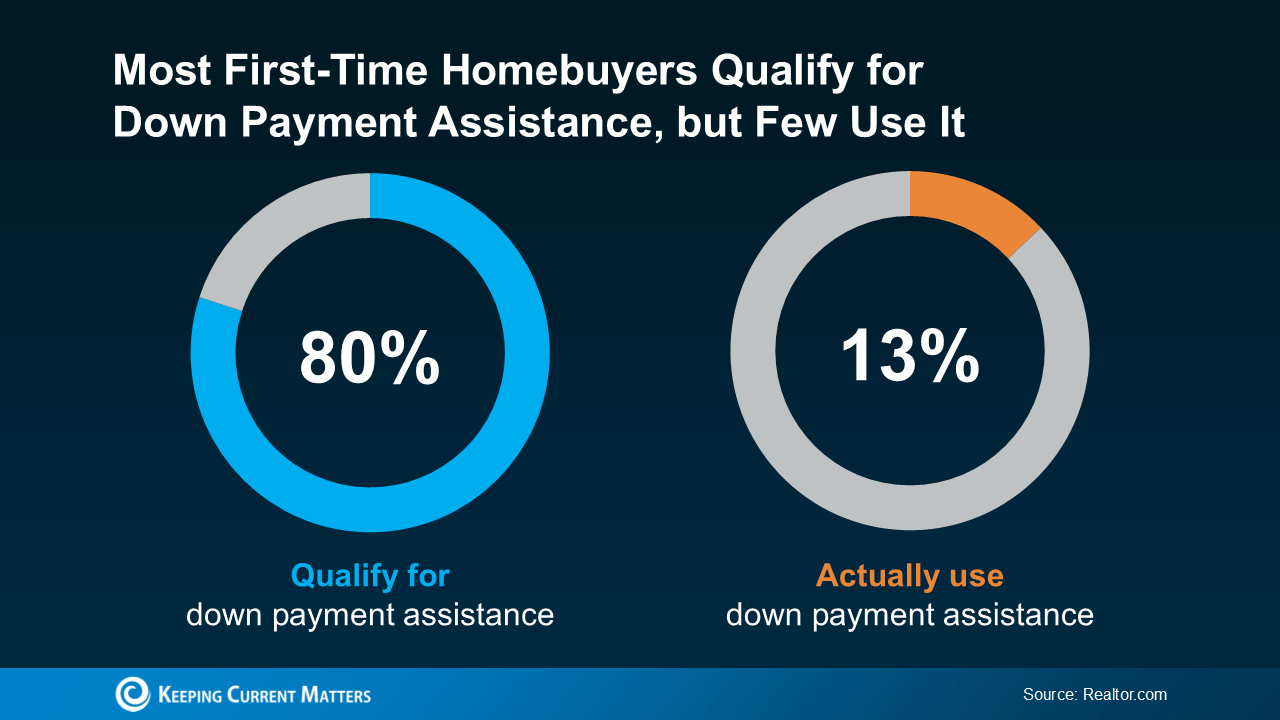

Believe it or not, almost 80% of first-time homebuyers qualify for down payment assistance (DPA), but only 13% actually use it (see chart below):

That’s a lot of missed opportunity. These programs aren’t small-scale help, either. Some offer thousands of dollars that can go directly toward your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

That’s a lot of missed opportunity. These programs aren’t small-scale help, either. Some offer thousands of dollars that can go directly toward your down payment. As Rob Chrane, Founder and CEO of Down Payment Resource, shares:

“Our data shows the average DPA benefit is roughly $17,000. That can be a nice jump-start for saving for a down payment and other costs of homeownership.”

Imagine how much further your homebuying savings would go if you were able to qualify for $17,000 worth of help. In some cases, you may even be able to stack multiple programs at once, giving what you’ve saved an even bigger lift. These are the type of benefits you don’t want to leave on the table.

Boston Condos for Sale and the Bottom Line

Saving up for your first home can feel like a lot, especially if you’re still thinking you have to put 20% down. The truth is that’s a common myth. Many loan options require much less, and there are even programs out there designed to boost your savings too.

To learn more about what’s available and if you’d qualify for any down payment assistance programs, talk to a trusted lender.

Updated: Boston Real Estate Blog 2025

Peace be with you

Back Bay Condos for Sale in 2025

This content is currently unavailable. Please check back later or contact the site's support team for more information.

Click Here > Boston Back Bay Apartments for Rent

Ford Realty Inc., Boston Real Estate for Sale

Click to View Google Reviews for 2025

++++++++++++++++++++++++++++++++++++++

How much do I need for a downpayment on a Boston condo?

How much do I need for a downpayment on a Boston condo?

If you’re planning to buy a Boston Beacon Hill condo, saving up for all the costs involved can feel daunting, especially when it comes to the down payment. That might be because you’ve heard you need to save 20% of the home’s price to put down. Well, that isn’t necessarily the case.

Unless specified by your loan type or lender, it’s typically not required to put 20% down. That means you could be closer to your homebuying dream than you realize.

As The Mortgage Reports says:

“Although putting down 20% to avoid mortgage insurance is wise if affordable, it’s a myth that this is always necessary. In fact, most people opt for a much lower down payment.”

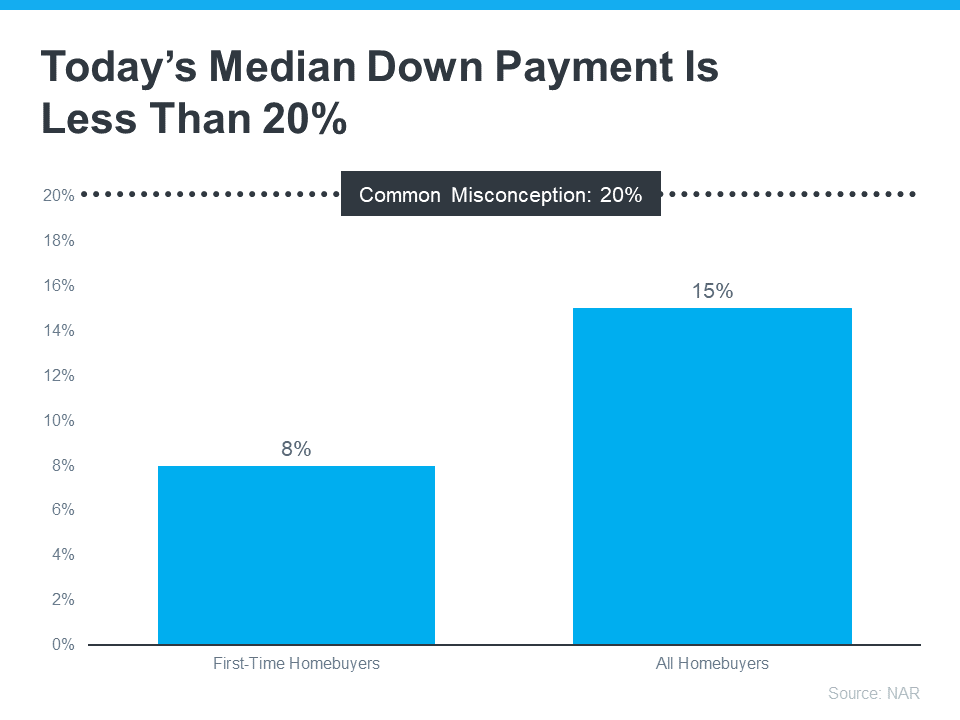

According to the National Association of Realtors (NAR), the median down payment hasn’t been over 20% since 2005. In fact, for all homebuyers today it’s only 15%. And it’s even lower for first-time homebuyers at just 8% (see graph below):

The big takeaway? You may not need to save as much as you originally thought.

Learn About Resources That Can Help You Toward Your Goal

According to Down Payment Resource, there are also over 2,000 homebuyer assistance programs in the U.S., and many of them are intended to help with down payments.

Plus, there are loan options that can help too. For example, FHA loans offer down payments as low as 3.5%, while VA and USDA loans have no down payment requirements for qualified applicants.

With so many resources available to help with your down payment, the best way to find what you qualify for is by consulting with your loan officer or broker. They know about local grants and loan programs that may help you out.

Don’t let the misconception that you have to have 20% saved up hold you back. If you’re ready to become a homeowner, lean on the professionals to find resources that can help you make your dreams a reality. If you put your plans on hold until you’ve saved up 20%, it may actually cost you in the long run. According to U.S. Bank:

“. . . there are plenty of reasons why it might not be possible. For some, waiting to save up 20% for a down payment may “cost” too much time. While you’re saving for your down payment and paying rent, the price of your future home may go up.”

Home prices are expected to keep appreciating over the next 5 years – meaning your future home will likely go up in price the longer you wait. If you’re able to use these resources to buy now, that future price growth will help you build equity, rather than cost you more.

Boston Condos for Sale and the Bottom Line

Keep in mind that you don’t always need a 20% down payment to buy a home. If you’re looking to make a move this year, let’s connect to start the conversation about your homebuying goals.

_______________

How much do I need for a downpayment on a Boston condo?

Click Here to view: Google Ford Realty Inc Reviews

Where is Ford Realty Located?

Ford Realty is located in 137 Charles Street in Beacon Hill

Ford Realty Beacon Hill – Condo for Sale Office

Boston condos for sale – Ford Realty Inc

Updated: Boston Condos for Sale Blog 2024

John Ford Boston Beacon Hill Condo Broker 137 Charles St. Boston, MA 02114

________________________

How much do I need for a downpayment on a Boston condo?

Is the idea of saving for a down payment holding you back from buying a Boston condo for sale right now? You may be eager to take advantage of today’s low mortgage rates, but the thought of needing a large down payment might make you want to pump the brakes. Today, there’s still a common myth that you have to come up with 20% of the total sale price for your down payment. This means people who could buy a Boston downtown condo may be putting their plans on hold because they don’t have that much saved yet. The reality is, whether you’re looking for your first condominium or you’ve purchased one before, you most likely don’t need to put 20% down. Here’s why.

According to Freddie Mac:

“The most damaging down payment myth—since it stops the homebuying process before it can start—is the belief that 20% is necessary.”

If saving that much money sounds daunting, potential Boston real estate buyers might give up on the dream of homeownership before they even begin – but they don’t have to.

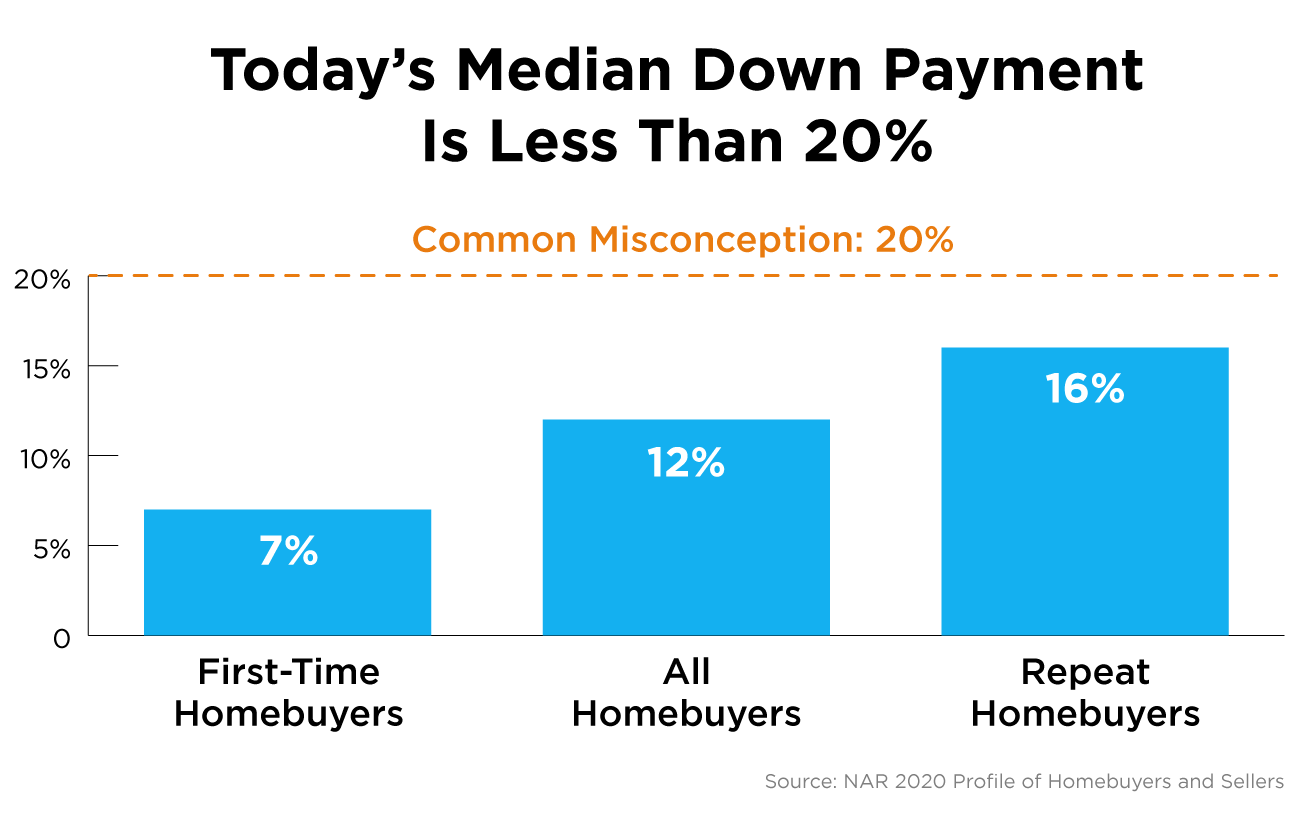

Data in the 2020 Profile of Home Buyers and Sellers from the National Association of Realtors (NAR) indicates that the median down payment actually hasn’t been over 20% since 2005, and even then, that was for repeat buyers, not first-time homebuyers. As the image below shows, today’s median down payment is clearly less than 20%.

What does this mean for potential homebuyers?

As we can see, the median down payment was lowest for first-time buyers with the 2020 percentage coming in at 7%. If you’re a first-time buyer and putting down 7% still seems high, understand that there are programs that allow qualified buyers to purchase a home with a down payment as low as 3.5%. There are even options like VA loans and USDA loans with no down payment requirements for qualified applicants.

It’s important for potential homebuyers (whether they’re repeat or first-time buyers) to know they likely don’t need to put down 20% of the purchase price, but they do need to do their homework to understand the options available. Be sure to work with trusted professionals from the start to learn what you may qualify for in the homebuying process.

Boston Condos for Sale and the Bottom Line

Don’t let down payment myths keep you from hitting your homeownership goals. If you’re hoping to buy a home this year, let’s connect to review your options.

How much do I need for a downpayment on a Boston condo?

Types of Boston Real Estate Loans

The national average for down payments is 11%. But that figure includes first time buyers that put down as little as 3% down.. Let’s take a closer look.

FHA loans for first time condo buyers

While the broad down payment average is 11%, first time homebuyers usually only put down 3 to 5% on a home. That’s because several first-time home buyer programs don’t require big down payments. A longtime favorite, the FHA loan, requires 3.5% down. What’s more, some programs allow down payment contributions from family members in the form of a gift.

VA loans for Boston condos

Some programs require even less. VA loans and USDA loans can be made with zero down. However, these programs are more restrictive. VA loans are only made to former or current military service members. USDA loans are only available to low to-middle income buyers in USDA-eligible rural areas.

Conventional loans for Boston condos

For many years, conventional loans required a 20% down payment. These types of loans were typically taken out by repeat buyers who could use equity from their existing home as a source of down payment funds. However, some newer conventional loan programs are available with 3% down if the borrower carries private mortgage insurance (PMI).

Related Links –

What credit score do I need to have to buy a Boston condo for sale

What’s the difference between pre-qualified letter and commitment letter

How much of a down payment do I need to buy a Boston condo for sale?

Boston Condo for Sale Search