Pending home sales

Boston Condos for Sale and Apartments for Rent

Pending home sales

Pending home sales

Let’s start with the good news, Boston condo for sale inventory levels are on the rise, offering buyers more choices. In addition, month-over-month pending sales is going in the right direction.

However, pending home sales are slightly down compared with last year.

Peace be with you

Updated: Boston Real Estate Blog 2025

+++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

Ford Realty Beacon Hill – Condo for Sale Office

Boston condos for sale – Ford Realty Inc

Updated: Boston Condos for Sale Blog 2025

John Ford Boston Beacon Hill Condo Broker 137 Charles Street Boston, MA. 02114

Ford Realty Inc., Charles Street, Beacon Hill

Click Here to view: Google Ford Realty Reviews

*************************************************

Pending home sales

Pending home sales post surprise gain in February but remain sluggish

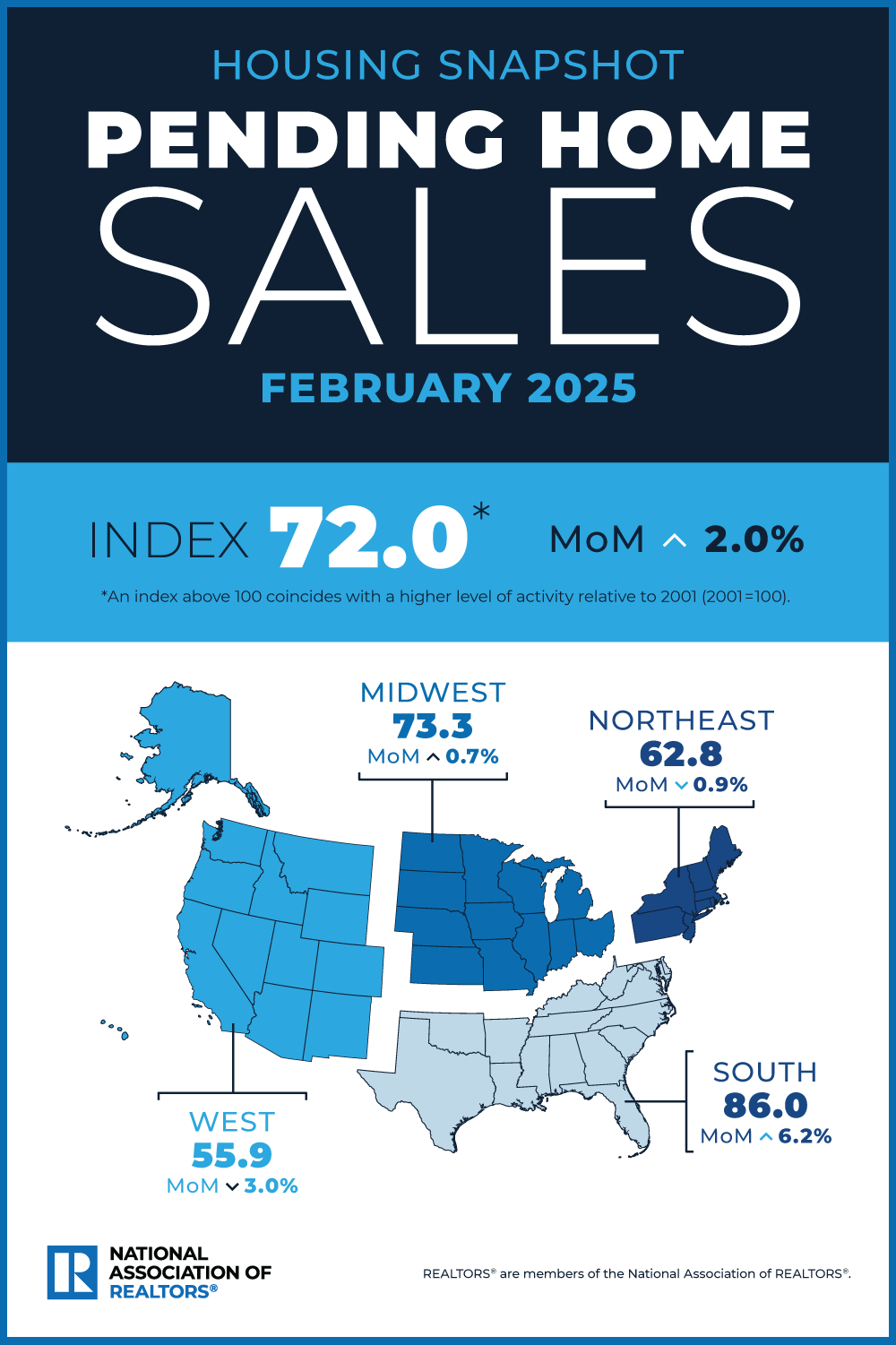

Pending home sales topped expectations in February but remained “well below” historical levels, the National Association of REALTORS® (NAR) said, citing its Pending Home Sales Index.

Pending home sales topped expectations in February but remained “well below” historical levels, the National Association of REALTORS® (NAR) said, citing its Pending Home Sales Index.

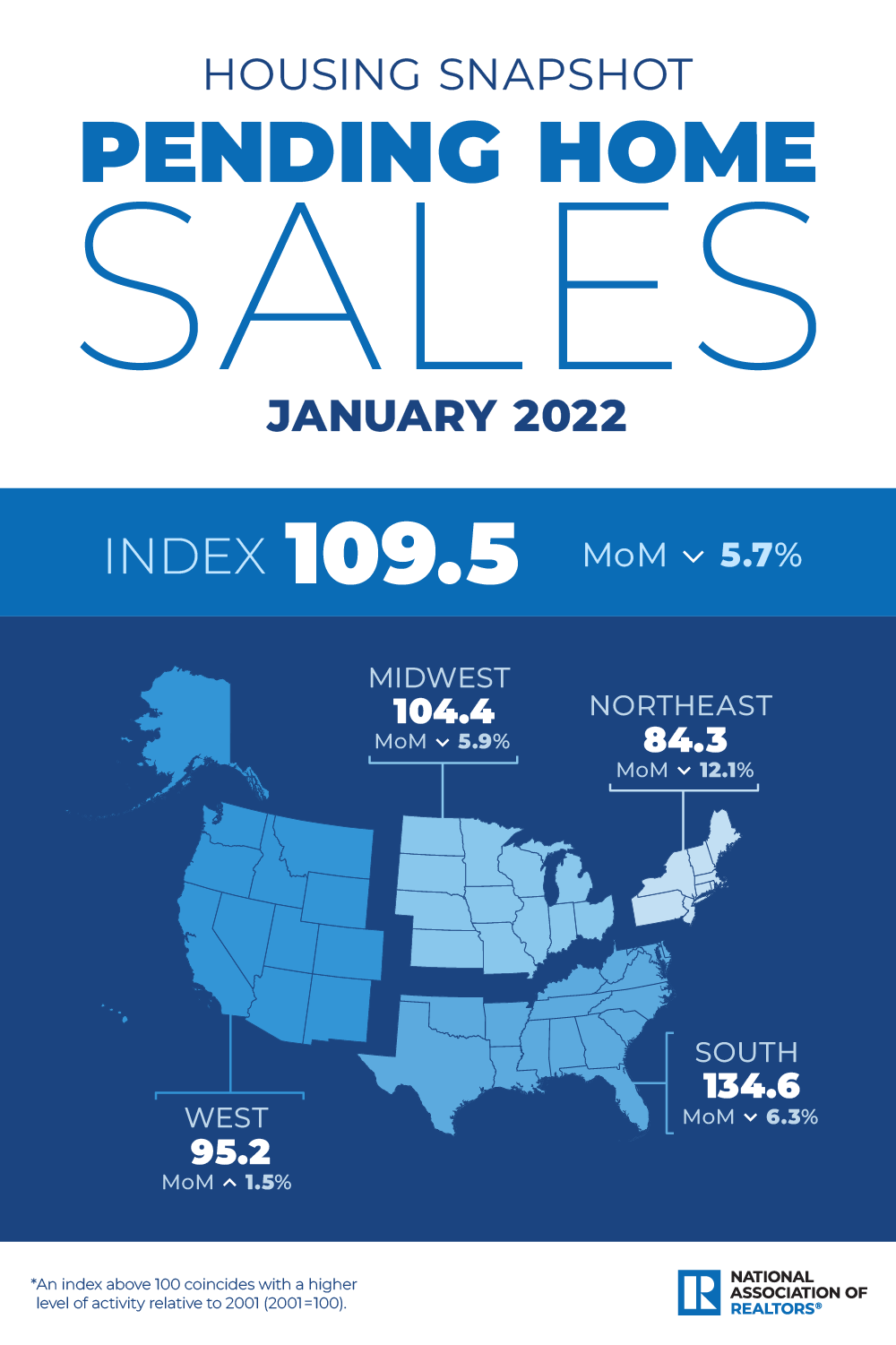

The index rose 2% month over month in February, compared to economists’ consensus estimate of a smaller 0.9% gain. Year over year, the index was down 3.6%.

“Despite the modest monthly increase, contract signings remain well below normal historical levels,” NAR Chief Economist Lawrence Yun said. “A meaningful decline in mortgage rates would help both demand and supply — demand by boosting affordability, and supply by lessening the power of the mortgage rate lock-in effect.”

“Considering the Federal Reserve’s recent forecast for slower economic growth, we expect mortgage rates to slide moderately lower,” said Yun. “But the current high national debt will prevent mortgage rates from falling drastically — and certainly not to the 4%-to-5% range seen during President Trump’s first term.”

Pending sales, in which the contract has been signed but the transaction has not closed, are considered a leading indicator and generally precede existing-home sales by a month or two.

“While pending home sales exceeded expectations in February, they are hovering near historical lows, signaling a slow start to the busy spring homebuying season,” First American Senior Economist Sam Williamson said. “Purchase mortgage applications — another leading indicator of housing activity — rebounded slightly in March but also remain well below historical levels.”

Pending home sales

_____________________

Pending home sales

_____________________________________________________________________________________________