What do higher mortgage rates mean to Boston condo buyers?

Boston Condos for Sale and Apartments for Rent

What do higher mortgage rates mean to Boston condo buyers?

If you’ve been thiking of buying a Boston Seport condo, you may be wondering whether you should wait to sell until mortgage rates come down before you spring into action. Here’s some information that could help answer that question for you.

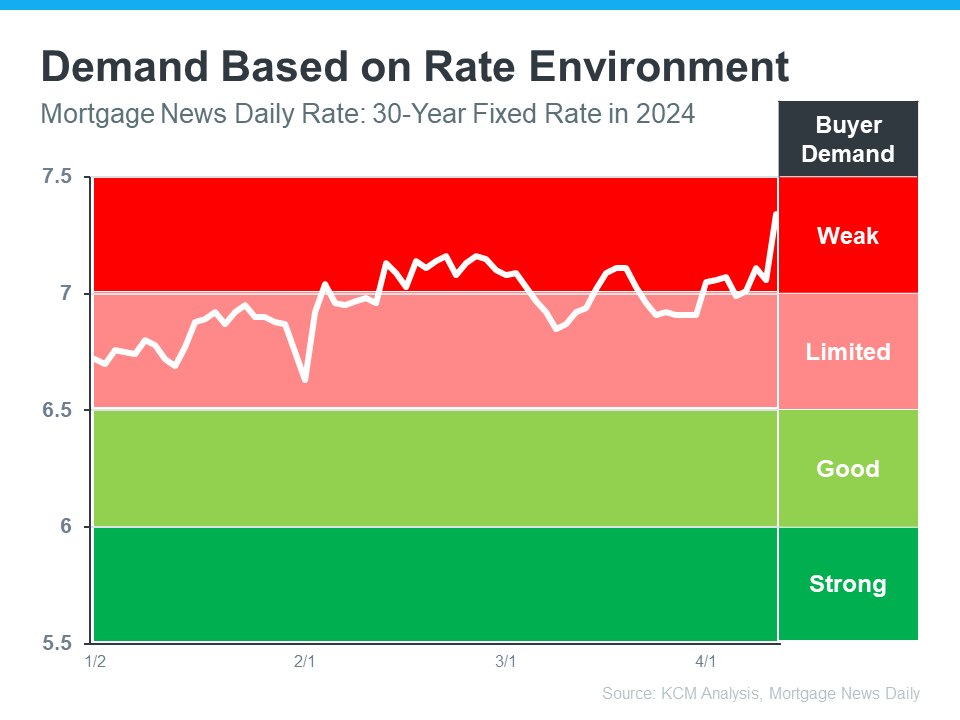

In the Boston condo for sale market, there’s a longstanding relationship between mortgage rates and buyer demand. Typically, the higher rates are, you’ll see lower buyer demand. That’s because some people who want to move will be hesitant to take on a higher mortgage rate for their next home. So, they decide to wait it out and put their plans on hold.

But when rates start to come down, things change. It goes from limited or weak demand to good or strong Seaport condo demand. That’s because a big portion of the buyers who sat on the sidelines when rates were higher are going to jump back in and make their moves happen. The graph below helps give you a visual of how this relationship works and where we are today:

As Lisa Sturtevant, Chief Economist for Bright MLS, explains:

“The higher rates we’re seeing now [are likely] going to lead more prospective buyers to sit out the market and wait for rates to come down.”

Why You Might Not Want To Wait To Buy That Seport Condo

If you’re asking yourself: what does this mean for my move? Here’s the golden nugget. According to experts, mortgage rates are still projected to come down this year, just a bit later than they originally thought.

When rates come down, more people are going to get back into the market. And that means you’ll have a lot more competition from other buyers when you go to purchase your next home. That may make your move more stressful if you wait because greater demand could lead to an increase in multiple offer scenarios and prices rising faster.

But if you’re ready and able to sell now, it may be worth it to get ahead of that. You have the chance to move before the competition increases.

Boston Seaport Condos for Sale and the Bottom Line

If you’re thinking about whether you should wait for rates to come down before you move, don’t forget to factor in buyer demand. Once rates decline, competition will go up even more. If you want to get ahead of that and sell now, let’s chat.

____________________

What do higher mortgage rates mean to Boston condo buyers?

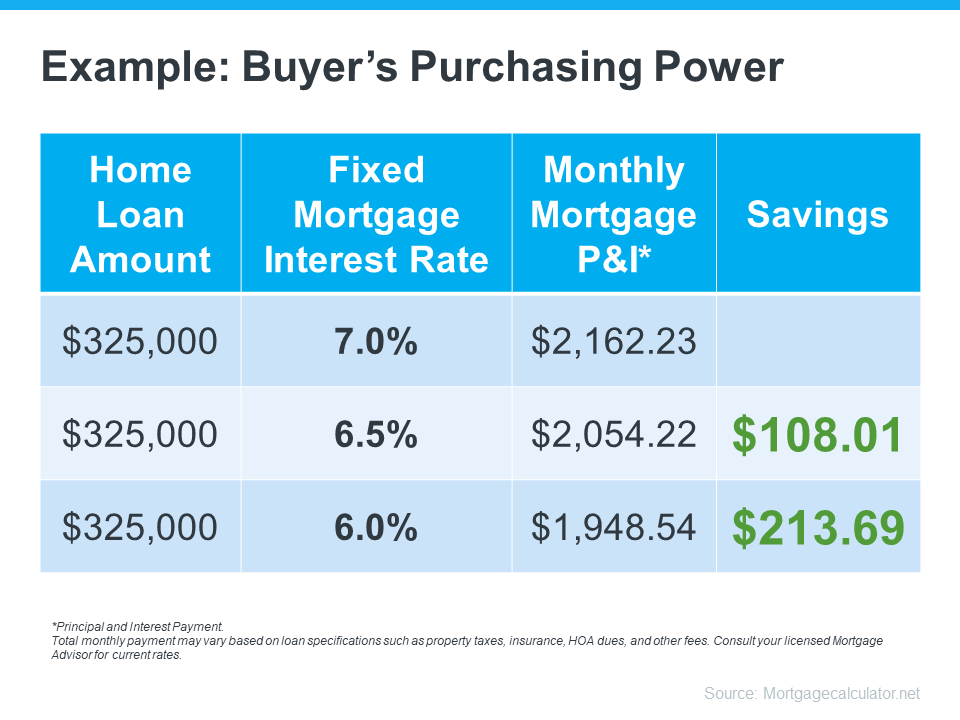

The 30-year fixed mortgage rate has been bouncing between 6% and 7% this year. If you’ve been on the fence about whether to buy a home or not, it’s helpful to know exactly how a 1%, or even a 0.5%, mortgage rate shift affects your purchasing power.

The chart below helps show the general relationship between mortgage rates and a typical monthly mortgage payment:

Even a 0.5% change can have a big impact on your monthly payment. And since rates have been moving between 6% and 7% for a while now, you can see how it impacts your purchasing power as rates go down.

What This Means for You

You may be tempted to put your homebuying plans on hold in hopes that rates will fall. But that can be risky. No one knows for sure where rates will go from here, and trying to time them for your benefit is tough. Lisa Sturtevant, Housing Economist at Bright MLS, explains:

“It is typically a fool’s errand for a homebuyer to try to time rates in this market . . . But volatility in mortgage rates right now can have a real impact on buyers’ monthly payments.”

That’s why it’s critical to lean on your expert real estate advisors to explore your mortgage options, understand what impacts mortgage rates, and plan your homebuying budget around today’s volatility. They’ll also be able to offer advice tailored to your specific situation and goals, so you have what you need to make an informed decision.

Bottom Line

Your ability to buy a home could be impacted by changing mortgage rates. If you’re thinking about making a move, let’s connect so you have a strong plan in place.

____________________________________________________________________________________________________________________

What’s going on with Boston condo mortgage rates?

Mortgage rates continue to fluctuate by nearly half a percentage point every month, leaving Boston condo buyers facing the most volatile three-month period they’ve seen since 1987.

What does this mean for Boston condo buyers?

What does this mean for those looking to buy a Boston condo for sale right now? It’s going to be expensive.

What does this mean for Boston condo buyers?

Can you provide an example of how mortgage rates impact Boston condo buyers?

Here’s an example. When potential Boston condo buyer started their search in early July, their expected monthly payment was $3,051 (with a 20% downpayment and a 5.7% mortgage interest rate. In early August, that monthly payment on the same home would have been $2,874 with a 20% downpayment and 4.99% mortgage rate. But if they actually purchased that home in late September, Redfin said the final monthly payment would be $3,202, with a 20% downpayment and the 6.29% mortgage rate.

But Redfin deputy chief economist Taylor Marr says the challenges homebuyers are facing in today’s market go beyond the “dwindling affordability caused by high mortgage rates and home prices.”

“The whiplash in mortgage rates between when homebuyers set their budget and when they make an offer is also making it extraordinarily difficult to plan ahead,” Marr said.

Why are Boston condo mortgage rates rising?

The reason behind the constantly changing mortgage rates is the Federal Reserve raising interest rates to help temper inflation. Last week, interest rates rose from 3% to 3.25%, and they are predicted to reach 4.4% by year’s end.

How long will we see mortgage rate volatility?

Justin Dimler of Redfin’s mortgage company Bay Equity said mortgage rate volatility will likely continue in the near term but we should see some relief in mortgage rates, as they are expected to fall in the next 12 to 18 months if inflation eases as expected.