Boston Real Estate for Sale

I want to buy a Boston condo. How do I get a pre-approval letter?

_________________________

I want to buy a Boston condo. How do I get a pre-approval letter?

Whether as a first-time Boston Beacon Hill condo buyer or as an investment property, purchasing a condominium is a great way to enter the housing market. Its flexibility, convenient amenities, low maintenance, and affordability are just some of the reasons why condos are a popular choice for homeowners today.

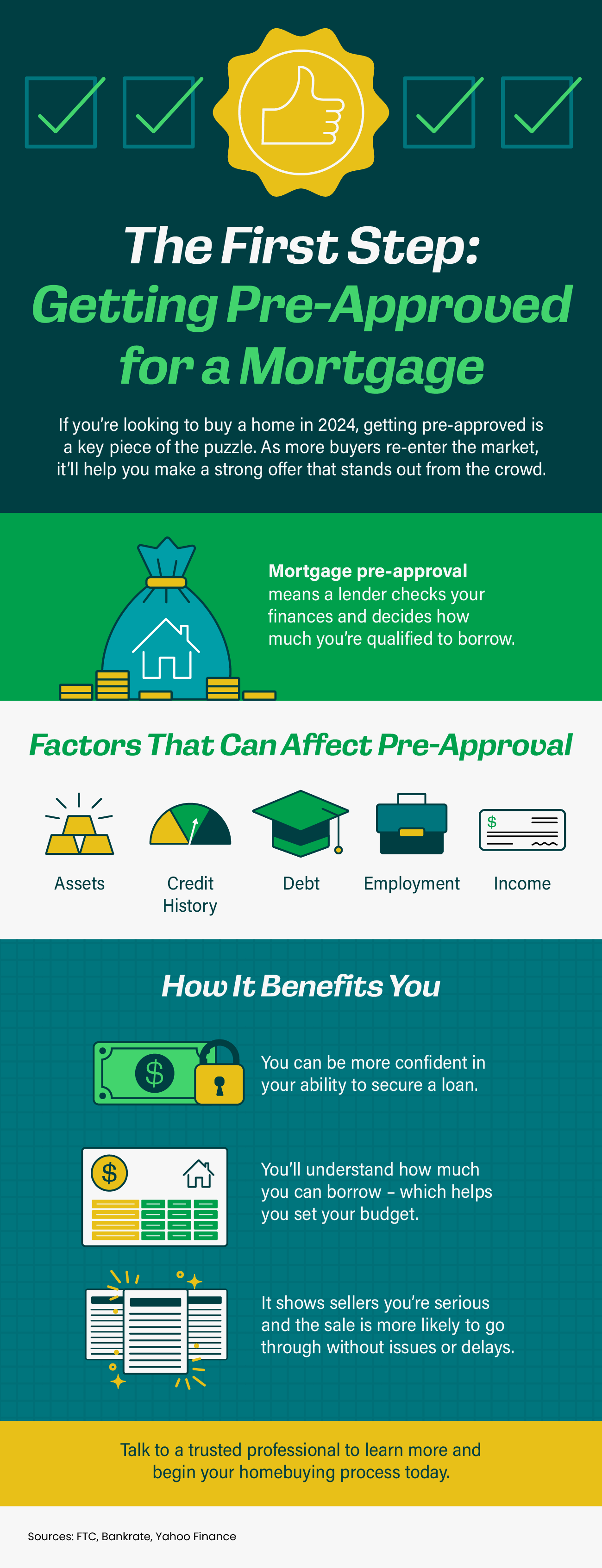

When you’re ready to start shopping for a condo in Back Bay or another part of downtown Boston, it’s important to get pre-approved for a mortgage. A condo mortgage pre-approval is different from a regular home mortgage pre-approval in a few key ways. Here’s what you need to know – read on!

WHAT DO I NEED TO BE PRE-APPROVED FOR A MORTGAGE?

A Boston condo mortgage pre-approval is a letter from a lender that indicates how much money you would be eligible to borrow to purchase a condominium unit. Getting a condo mortgage pre-approval can give you a competitive edge when bidding on units and help you determine what price range you should be looking for.

Keep in mind that just because you are pre-approved for a certain amount doesn’t mean you have to spend as much. You can always choose to put down a larger down payment or take out a smaller loan. The pre-approval amount is based on your income, employment history, credit score, and other factors.

WHAT ARE THE PRE-APPROVAL REQUIREMENTS FOR A CONDO MORTGAGE?

In order to get pre-approved for a condo mortgage, you will need to meet specific requirements set by the lender. These requirements may include:

A minimum credit score: Most lenders will require you to have a credit score of at least 620 to qualify for a condo mortgage.

A minimum down payment: You will likely need to put down a larger down payment for a condo than you would for a traditional home. The minimum down payment is typically 10%, but it can vary depending on the lender.

Proof of income and employment: You will need to provide the lender with confirmation of your income and employment history to get pre-approved for a condo mortgage. This may include tax returns, pay stubs, and W-2 forms.

Assets and liabilities: The lender will also want to know about your assets and liabilities to determine how much of a risk you are. This may include bank statements, investment account statements, and information on any other debts you may have.

Condominium association approval: To get a condo mortgage, the condominium complex must be approved by the lender. The lender will likely require that the complex meet certain requirements, such as having a certain percentage of units owner-occupied, adequate insurance coverage, and being financially sound.

HOW DO I GET PRE-APPROVED FOR A CONDO MORTGAGE?

If you’re ready to get pre-approved for a condo mortgage, the first step is to find a lender that offers this type of loan. Once you’ve found a lender, you’ll need to fill out a loan application and provide the required documentation. Once your application is complete, the lender will review it and determine if you’re pre-approved for a loan.

If you are pre-approved for a condo mortgage, the lender will give you a pre-approval letter outlining the loan terms. This letter will be helpful when you’re ready to start shopping for a condominium unit.

_______________________________________________________________________________________________

What exactly is a verified pre-approval?

The verified pre-approval is an underwriter-reviewed pre-approval, or in layman’s terms, when your finances—your income, debt, assets, and credit history—have been reviewed by an underwriter, or a financial risk analyst, to determine how much money you can borrow, how much you can afford per month, and what your interest rate will be.”

What do I need to be eligible?

Being in solid financial standing is wise for any Boston Seaport condo buyer looking to make a move. There are certain terms of eligibility customers must meet in order to use our Trade-In program. These may include things like savings for a down payment, or “good” credit.

- Minimum down payment: 5% (3% for first time home buyers)

- Credit score minimum: 620

- Maximum debt-to-income ratio: 50%

- Bankruptcy, Chapter 7 or 11 -> 4 year waiting period

- Bankruptcy, Chapter 13 -> 2 years from discharge date, 4 years from dismissal date

- Foreclosure -> 7 year waiting period

- Deed-in-lieu of foreclosure, pre foreclosure sale, charge-off -> 4 year waiting period

*Note these underwriting guidelines are mandated by Fannie Mae for conventional financing.

What documents will I need to submit?

We get it, no one likes sifting through paperwork. But, having the below documents ready to submit will help expedite the process.

- Bank statements: Checkings and savings for the last two months

- Other statements: Your two most recent statements (either for last two months or last two quarters) for all other assets and reserves, such as investment and retirement accounts

- A credit report: You can use an app like Credit Karma to pull your credit without impacting your score

- Employment documents: W-2 forms for the last two years and pay stubs for the last 30 days

- Tax documents: Federal and state tax returns for at least the last year

- Homeownership documents: Mortgage statements and homeowners insurance declarations for your primary residence and any rental properties

- Investment documents: Any current lease agreements for investment properties you already own, as well as official closing documents

- Home inspection documents: Most of the time your mortgage lender will do an appraisal of the house. But it’s smart to pay for a home inspection yourself before you make an offer, so there are no surprises down the line

- Personal documents: Bankruptcy, divorce, or separation papers, if applicable

How long will it take to get my verified approval?

We know that time is of the essence. And we also know that you’re especially excited to start looking for your new Boston Seaport condo for sale. But, we don’t want you to fall in love with a Boston downtown condo that’s outside of your budget. Luckily, we are able to move the process along quickly.

When you’re ready to find your new Boston condo for sale, we suggest checking out this Boston condo website.. You can set up alerts for your dream home based on your desires and requirements and we’ll alert you when you can get it for the best price.

The Financial Finale

One of the first step in the financial process when getting started with your search for a Boston Seaport condo is a pre-approval. Although you can always choose to use your own mortgage lender, we have solid partnerships with companies that are familiar with our process and whose mission is to improve access to home finance.

Ready to get started? Before you can get your verified pre-approval from a provider, and give us a call to start your Boston condo sales journey, Please feel free to call/text me at 617-595-3712